Unlike the millennial generation, where the birth years may vary from source to source, the baby boom is widely defined as those born between 1946 and 1964. While those early boomers were either protesting the Vietnam War or participating in it, it is the back half of the generation that produced the greatest population numbers. From 1954 to 1964, more than 4 million children were born annually in the U.S. As we turn our calendars to 2021, this represents year three of what will be 11 straight years where 4 million people will turn 65—about one person every seven seconds. The rest of this decade will see record demand for active adult housing, and Florida remains a top choice for retirees due to the climate, the lack of a state tax, and affordability.

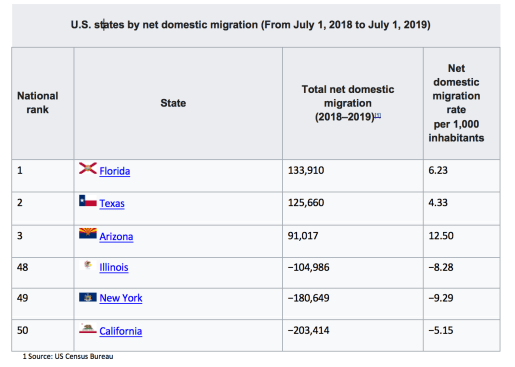

Florida’s West Coast has always benefited from retiree demand along the I-75 corridor. This is now being supplanted by growth coming from the I-95 corridor. Based on the latest available Census Bureau data, a New York to Florida move trailed only California to Texas, California to Arizona, and New York to New Jersey in terms of population movement in 2019. The chart below shows the top three and bottom three states for domestic migration from July 1, 2018, to June 30, 2019 (pre-COVID-19):

The Florida markets don’t just benefit from retirees but also from job growth. While 2020 was a “bust” in terms of job creation, the expansion of work from home created demand for housing, especially in affordable markets, like Florida’s West Coast. As stated in an Oct. 27 Miami Herald article, “According to real estate firm FCP and geospatial analytics group Orbital Insight, Tampa was the No. 1 relocation destination for Americans who have moved during COVID.” Moreover, the rebound in jobs have come quicker along Florida’s West Coast. Statewide employment is down 4.6% from November 2019 to November 2020. All three major Florida West Coast markets were below the statewide average for job contraction over the past 12 months.

The following reflects major Florida core-based statistical areas’ job growth over the past 12 months:

- Orlando, down 9.4%

- Miami, down 6.5%

- Florida, down 4.6%

- Sarasota, down 4.3%

- Tampa, down 3.9%

- Naples/Fort Myers, down 3.8%

With the peak of the baby boom occurring in 1957, demand from retirees will continue to rise over the next few years and then remain strong through 2029 when the last of the boomers turn 65. With snowbird season upon us and job recovery outpacing the state, the outlook for Florida’s West Coast remains strong both short term as well as long term.