The newest Senior Loan Officer Opinion Survey (SLOOS) has been released by the Federal Reserve. This was one of the most anticipated economic data releases in recent memory following the turmoil in the U.S. banking system.

The report highlighted tighter credit conditions for both large and small companies across the economy. It also showed an expectation for the continuation of more restrictive lending standards throughout the rest of 2023.

In response to this new data and another short-term rate increase from the Federal Reserve in May, we examine three key questions related to future rate hikes, mortgage lending, and construction financing.

1. Tighter financial conditions and the Fed. The Federal Reserve moved toward restrictive monetary policy in March 2022 and has raised short-term interest rates 10 times since. The Fed has been raising rates to slow the overheated economy.

There are rumblings that the Fed may pause on further hikes to see how the economy progresses. Chairman Jerome Powell did not promise a pause, but he did not explicitly mention further hikes, either.

The Fed’s pause is contingent on the economy continuing to decelerate. The trends collected in the SLOOS pose an interesting question: Will the tighter (and tightening) access to credit ultimately do the job for the Fed by slowing economic growth enough that it feels a pause is warranted?

2. Some changes to mortgage credit availability. A key question for the home building industry should be: Are there signs mortgage credit availability is tightening?

Right now, the answer is yes, but only in some cases.

The Fed reported that lending standards tightened for only some loan types, including subprime mortgages, home equity lines of credit, and select jumbo mortgages. This is in line with data from the Mortgage Bankers Association (MBA) that also reported a tightening of mortgage lending. The MBA data shows that mortgage credit availability reached a low last observed in 2013.

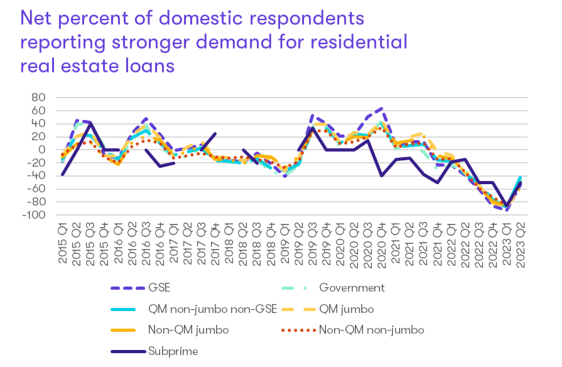

Further, the graph below shows that banks reported lower levels of demand compared with last year in many categories, matching Zonda’s housing data on lower total sales.

Source: Zonda

3. Concerns about construction financing. The SLOOS does not explicitly ask about construction loans for residential real estate, but it does track demand and availability for commercial real estate loans. The first quarter data showed lower levels of demand for commercial loans but also tightening credit standards (see graph below).

The question here is: Are these constraints impacting residential construction as well?

The NAHB shed some light on this with its acquisition, development, and construction (AD&C) financing survey. The latest report from the NAHB showed that AD&C financing has become harder to obtain and more costly. Further, Zonda’s builder survey data captured that one-third of builders are concerned about restricted lending as of April.

Access to financing is the backbone to the U.S. economy and can determine the growth trajectory. We’ll continue to monitor the data and check back on these three key questions throughout the year.