As a luxury priced market, San Francisco has been particularly impacted by slumping tech stocks and tech layoffs.

Despite these layoffs, the Bay Area housing market showed signs of picking up at the beginning of 2023 after a lull in sales in the latter half of 2022. Opportunistic buyers have been re-emerging to seize on prices that have dropped from their Q2 2022 peak.

It remains to be seen if buyer activity will continue to improve. On March 10, the sudden collapse of Silicon Valley Bank, one of the main places California tech startups deposited their investment cash, unearthed fears that the condition of the local tech industry could worsen.

Strengths

Laid-off tech workers are still in high demand, and some are finding jobs at lower-profile tech companies and in other industries. As the AI race heats up, many of the largest VC funding rounds for AI and related companies have occurred in the Bay Area.

Weaknesses

The redevelopment of Concord Naval Weapons Station, the Bay Area’s largest proposed housing development with 15,000 units, has been stalled again after the Concord City Council—for the second time in three years—fired the developer by not approving a term sheet.

Supply

Quarterly housing starts decreased 53.3% from a year ago in Q4, while the number of available vacant developed lots sits at 2,984 down 23.5% from the same quarter last year. In terms of supply-demand balance, the market area is 5.5% under-supplied.

Sales

New-home sales in the San Francisco-Oakland-Berkeley metropolitan area decreased 51.4% year over year to an annualized rate of 2,377 units in January. Over the past 12 months, 1,302 of sales were attached units and 1,075 were detached. Existing-home closings for the 12-month period ending in January posted a year-over-year decline of 30.9% to an annualized rate of 41,454 units. Of those, 12,507 were attached units and 26,083 detached.

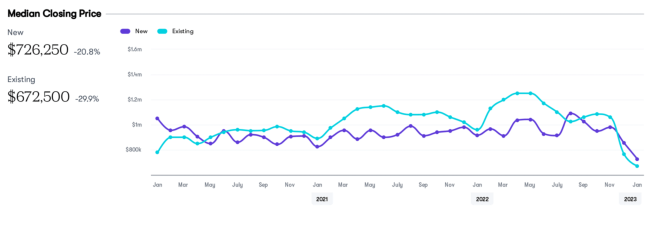

Prices

The average list price for a new detached home in the Bay Area decreased 21.5% from 2022 to $887,852 in February while the average list price for a new attached home decreased 14.3% over the same period to $1,142,460. The new-home affordability ratio for a detached home reached 30.1% in February.

Economy

The local unemployment rate increased 2.8% in December compared with 2.7% in the previous month. December 2022’s jobless rate is lower than it was at the same time last year when it stood at 4.4%. Zonda forecasts the region’s unemployment rate will finish this year at 2.2%.

Community

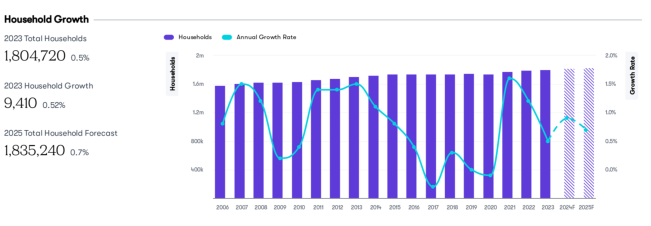

The current population for the San Francisco-Oakland-Berkeley MSA is approximately 4,801,420 people. Population in the area is projected to increased by 0.6% in 2023. There are approximately 1,804,720 households in the region, which is up 0.5% year over year. Forecasts show that current household formation is expected to increase by an annual growth rate of 2.1% for 2027. Incomes increased by 10.2% from the previous year to $135,528.

Did you know you can access free housing data with Zonda’s Market Snapshots? Reports include new-home supply and valuation, resale listings, jobs, market forecasts, and more. Get your complimentary market snapshot for your local CBSA today.