Homeownership rates matter, but they matter over the long term. However, the long term means predicting, which, as Yogi Berra noted, nobody’s very good at.

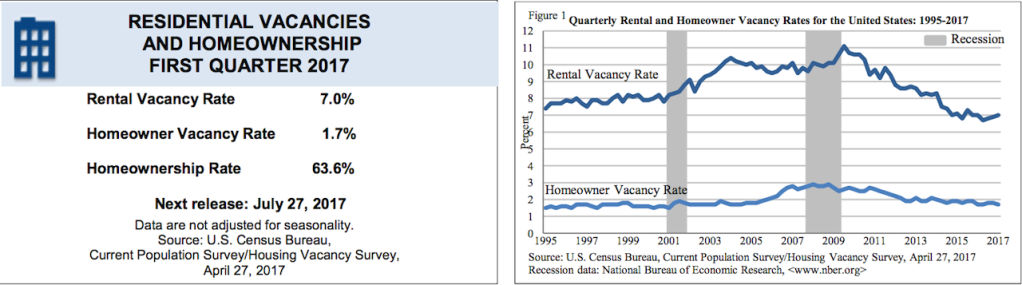

What’s more, it’s a matter of debate whether this measure of homeownership rates is worth the zeros and ones in its digital code. What matters about homeownership rates now is that they appear to have hit a bottom, at just under 64%, and new directional evidence shows that rates may have tipped forward toward improvement .

Home builders–despite land investments 36 and 48 months ahead–need to excel in the short term in order to make long term trends matter. We’ve said it here before. Sheer demographic heft, one way or another, means little to builders because builders always have to do more to draw demand to them than resales, or single-family rentals, or some other builder doing a community down the road from them. They have to stand out, with product, price, and location.

Still, for the second time inside of a week, evidence has begun to point to the fact that homeownership is the housing preference among young adults after all. Last week, we saw that show up in Zelman & Associates analysis of Google search data that show marriages and having babies are spiking as terms people are searching online.

Marriages and new babies have always gone hand in hand with homeownership demand. Maybe that demand has already started showing up.

Trulia chief economist Ralph McLaughlin, always one to look in fresh ways at data including the Housing Vacancy Survey from the Census Bureau, sees a take on it few other housing analysts detected.

For the first time in nearly 11 years–going back to 2006, the number of owner occupied households grew faster than renter households. The number of new owner households grew by over 850,000 in the first quarter of 2016, which is over double that of renter formation at just 365,000. Strong renter household formation is one of the reasons why the homeownership rate has continued to drop since the onset of the housing crisis, so any sign this trend is reversing is something to take note of.

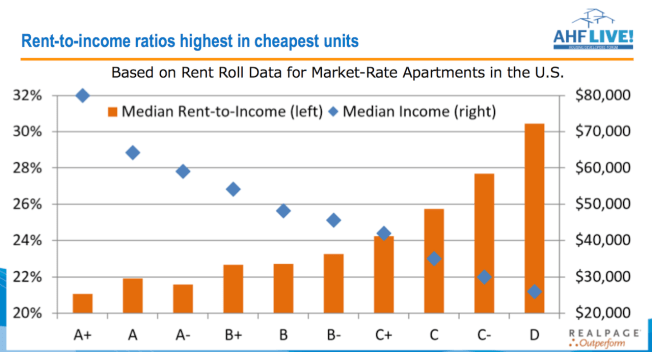

One of the reasons for this may be pent-up demand releasing, possibly related to the fact that rents have been increasing, and rent-to-income ratios are creating a greater and greater mismatch for households making barely median incomes. Here, a slide from John Sebree, VP and National Director for Multifamily at real estate investment consultancy Marcus & Millichap, illustrates an increasing rent-to-income ratio for each descending apartment type.

New owners may be–as long as income levels head up directionally and lenders expand their credit box–rental refugees.

Wall Street Journal staffer Laura Kusisto reports other perspectives on the inflection point in new homeowners vs. renters as well:

The creation of more new-owner households also indicates Americans are more confident in the economy.

“People are looking at housing as being a bit more attractive as memories of the financial crisis fade,” said Joseph LaVorgna, chief U.S. economist with Deutsche Bank.

What’s been in question since the end of the recession and the beginning of this ever-so-slowly materializing housing recovery is whether young adult buyers can or would engage, do their thing, and give the rebound some spring.

What’s beginning to come clear is that Recession after-effects, including student debt, have created a lag in both household, family, and ownership rates for the latest crop of young adults, but that logjam appears to be breaking up as incomes, specifically among the college educated, start accelerating, college loan debt becomes a smaller percentage of the household monthly balance sheet, and lifestage demands and dreams kick in.

As Trulia’s McLaughlin notes, it will be fascinating to stay tuned to see whether homeownership rates outpace new rental formations in the months ahead, especially with rent power fueling increases throughout the land.

As CoreLogic economist Shu Chen notes, supply of for-sale housing is having a very difficult time keeping up with demand, and supply of affordable housing of any type is falling behind a surge in released pent-up demand.

The good news is, home builders have the option–albeit hard to seize upon–of being part of the solution, not an additional contributor to the problem.