For generations, U.S. household formations have followed a distinct timeline: Children move out of parents’ homes to go to college, leave college, rent their own place, get married, buy a home, and years later buy a move-up home.

Today, these timelines are changing. New generations are starting households later in life. Leonard Kiefer, deputy chief economist at Freddie Mac, speaks to some of the impediments to household formation in this short video.

At the same time that buyers are slowing down their timeline for purchase, builders are slowing down construction. Kiefer attributes that to lack of land and labor, and doesn’t see a quick solution for either.

Paige Shipp, regional director at Metrostudy, also shows that even as new household formations continue to increase, millennial household formation is slower than previous generations. Why?

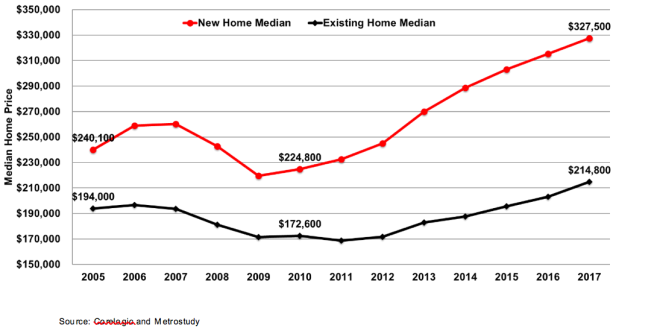

Corelogic and Metrostudy

“Millennials rent longer than previous generations due to higher levels of debt, and enjoying a renter’s lifestyle,” Shipp says. “They also are facing the highest rental prices in history, which makes it hard to save for a down payment. And, they were scarred by watching friends and families go through the recession, making them a very pessimistic group. Finally, rapid housing price appreciation has limited the options available for them to move into a first-time product.”

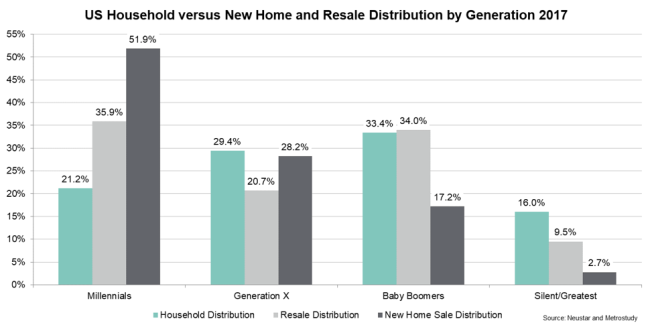

Now, not only are millennial emerging as home buyers, but they are also choosing—at staggering rates—to buy new over resale. In this Metrostudy and Neustar chart, the green bars show that millennials are dominating new-home sales, with nearly 52% of all new-home sales.

Neustar and Metrostudy

As Kiefer points out, there is not a lot of entry-level product for this group to move into, even though the Metrostudy numbers show it’s their preference. Kiefer anticipates that the demand will build to a point that builders start to focus on this product in the next three to four years.