To crack the code on what the generation known as the baby boomers will want next in a home, you’ll have to talk to the 77 million people born between 1946 and 1964. Since that’s not likely, the next best thing might be to talk with a select few whose tastes, values, preferences, and influence over others will lend real insight into what the rest of the market-making cohort may desire in their retirement homes.

So earlier this year, Hanley Wood, BIG BUILDER’S parent company, and research firm DYG surveyed 2,000 homeowning boomers—aged 50 to 60 with household incomes averaging $100,000 or more—to find out what these soon-to-retire consumers want in their homes and communities as they move into the next stage of their lives. DYG then held eight follow-up focus groups of eight participants each in June in Chicago and Fairfax, Va. Results of the “Every 8 Seconds: American Housing as Boomers Turn 60” study were compared with a 2005 survey by DYG of “average” baby boomers.

This select sampling of trendsetting boomers, who may serve as bellwethers of their age-group’s wider behaviors and attitudes toward imminent home decisions, are called “Boomfluentials” in the study. Some survey results are both surprising and controversial, but each statistic offers builders insight into what this unique generation dreams about for its retirement years. This information can be translated into a truly vast array of opportunities, as two things emerged conclusively about baby boomers. They can’t be lumped together—they fill a lot of niches—and they not only want what they want, but they can afford it, too.

WHAT’S THE STORY? Conventional wisdom says that retirees want one-story, small homes, and the Hanley Wood research supports this, with 38 percent of the survey respondents interested in remodeling or moving so they can live on one floor and 58 percent willing to move to a smaller home. The flip side of these statistics represents those boomers who would be happy with two floors and a larger home. Both options represent opportunities for builders to create new housing products.

Kushner Cos. built two golf course communities on rolling, landscaped terrain on Long Island, with eight different house models. “The original design was for six of the eight models to have master suites on the first floor,” says Sam Gershwin, president of the Westminster Communities division of the company. “The other two models put all bedrooms on the second floor. In response to customers, we now have two new [one-floor] ‘ranch’ models.”

As for larger homes, Slenker Land Corp, which acts as the master planner for communities in Virginia, Maryland, and Delaware, has seen the number of single women buying homes in 55-plus communities increase dramatically in the past five years. “In our region, a mother and daughter or two sisters are selling their homes and then moving together into a 55-plus home,” says Bob Slenker, the company founder. “Especially in the last year in the Washington, D.C., area, there have been a lot of sales of those types. So we’ve started designing homes for a boomer to [live] with an aging parent who is not ill. These are homes with two master suites, where the boomers are upstairs, and mom, who is 84 and healthy, is downstairs.”

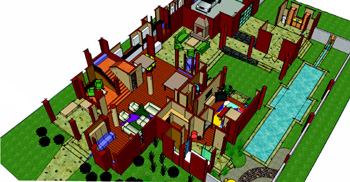

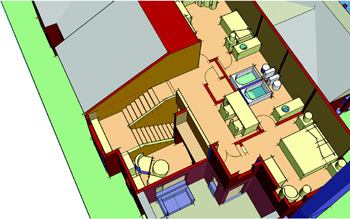

Another opportunity identified by “Every 8 Seconds” is the second home—44 percent of the participants show an interest in that option whether they would build, buy, or rent. Ed Binkley, partner-in-charge of the Orlando office of Bloodgood Sharp Buster Architects and Planners, calls this trend “home-splitting,” in which people live in more than one city. He’s designed a small home based on both Hanley Wood’s research and this trend. “Maybe [people] don’t buy a great big home in one place,” says Binkley. “They split the square footage between the two houses. Big builders can sell houses to these people in both markets.”

Such homes would fill different functions for their owners. “We are re-introducing the seasonal home,” says Steve Soriano, president of Robson Communities. These are lower-end, lower-price products, but Soriano stresses that “lower” doesn’t refer to the buyer’s income. “The buyer may be just as well off financially, but only plans to spend a few months there,” he says. “It’s impractical for them to buy a big house.”

Consultant Bill Becker, founder of the William E. Becker Organization, foresees big builders that operate in multiple markets selling boomers both primary and vacation homes. “Boomers are bored with what they have and where they live,” he says. “They’re looking at what they’re going to do with their leisure time. So builders can take advantage of this by selling two houses rather than one.”