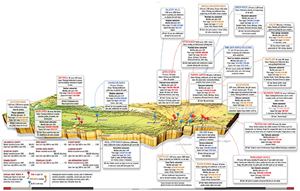

Builders, developers, and private equity funds are circling the residential real estate spoils of U.S. history’s largest bankruptcy. Nearly 26,000 acres, divvied into 21 California projects with more than 43,000 potential home-sites, make up failed business partnerships between Lehman Brothers Holdings and developer SunCal. “I think they have some of the best land in America” remaining for residential development, says Gadi Kauffman, CEO of Robert Charles Lesser and Co. The problem: It’s all locked up in multiple bankruptcies.

As the timing of a market turn nears, land managers are toiling to untangle the assets for potential sale. If that happens, it could be sold as early as this year as one or several portfolios filled with irreplaceable assets, including a couple hundred rare lots overlooking the Pacific in San Clemente and thousands of generic plots in the Inland Empire’s exurbs.

The net will likely exceed $500 million, say industry insiders. It would take a private equity fund or a well-capitalized builder, such as Toll Brothers, Lennar, M.D.C. Holdings, or Standard Pacific, with the help of its MatlinPatterson Global Advisors backer, to land such a land deal.