One of Ladies in Land’s key goals is professional education for its members, and boy, did Julie Peak ever deliver on that.

During an eye opening presentation to the group’s Houston chapter in June, Peak warned that “Texas tax law boobie traps” can cost builders and developers millions of dollars in bond reimbursements on their projects. In fact, she said it’s already cost one undisclosed company $5 million.

“We had real problems in a real deal. Departments collided and numbers were off and millions of dollars had to be taken off the table,” Peak said in a post-event interview.

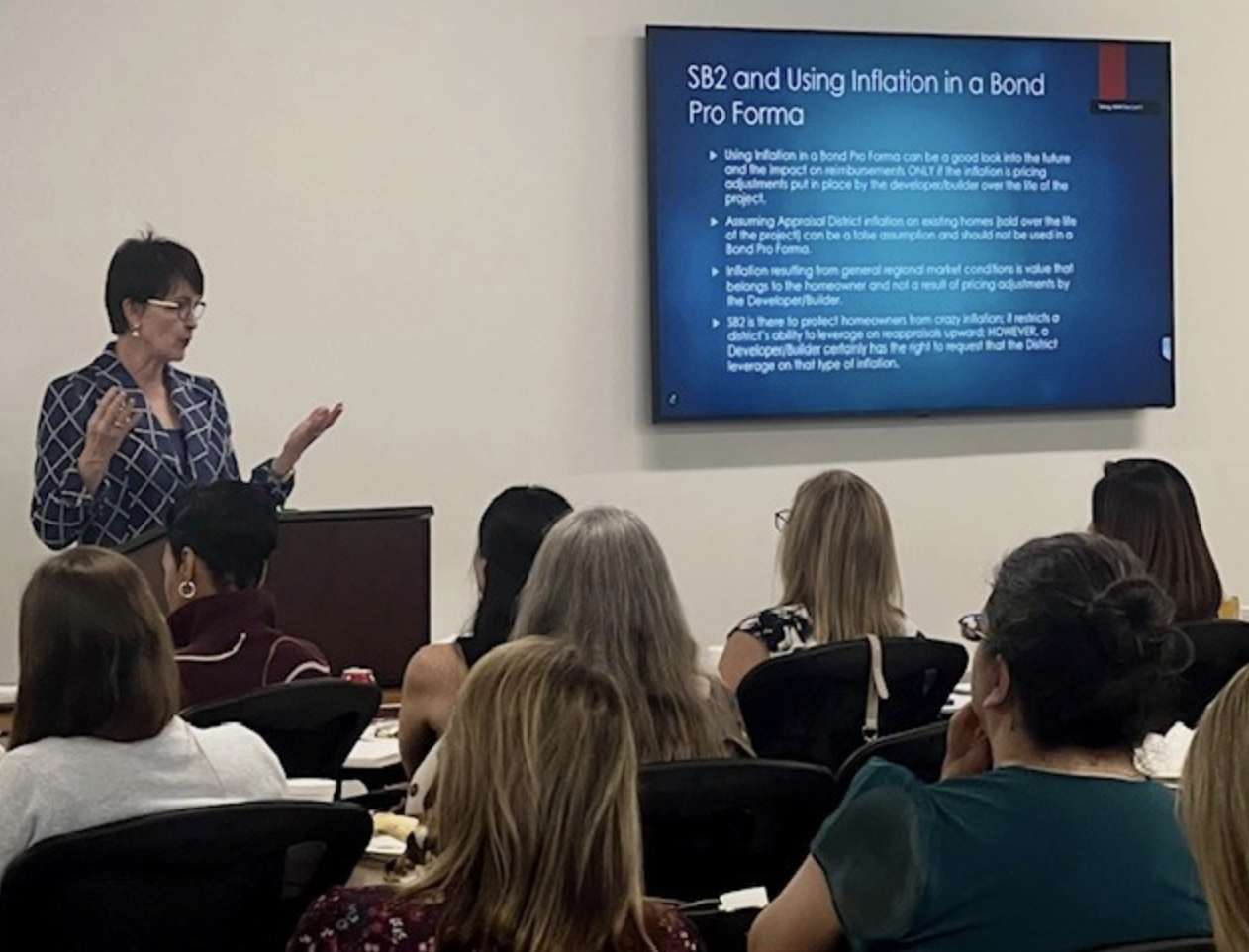

Peak, an investment banker and bond market specialist, is president of Masterson Advisors. During the LIL event, Peak explained how four Texas tax laws can dramatically cut into bond reimbursements that builders and developers expect to get back from a project: Senate Bill 2, veterans’ exemptions, over 65/disability exemptions and homestead exemptions.

Peak said the laws are designed to “do the right thing” for Texas buyers, but many industry players either aren’t aware of them or don’t understand their implications. That’s why LIL invited Peak to speak to its Houston chapter. (The Austin chapter also joined in by virtual simulcast).

“Julie talked about real stuff that’s impactful, that can change the way we do business,” said Ladies in Land CEO Erica Sinner. “I’ve worked in the business for 15 years but nobody’s even talking about (this issue),” adds Sinner, vice president of land acquisition and development at LGI Homes in Houston.

Peak’s presentation certainly meshed with LIL’s mandate: to provide professional development and educational opportunities to women who work in the land sector through events, mentorship and executive coaching.

One of the lightbulb moments in Peak’s keynote came when she urged builders and developers to break down silos between their own internal teams. She said land acquisition, sales, marketing and tax teams should all understand the four Texas tax laws and communicate regularly about potential implications on bond reimbursements.

“All of the departments may not be talking or speaking the same language. If the right hand doesn’t know what the left hand is doing, you can have problems three or four years into your project,” Peak said.

That message came through loud and clear for attendee Kim Ngan Ho.

“I now realize that I’ve been piloting deals with only half the instrument panel lit. Julie’s presentation helped me understand the hidden levers that can quietly steer a project’s success or derail its trajectory,” said Ho, land acquisition manager at David Weekley Homes in Houston.

“My biggest takeaway from Julie Peak’s presentation was that the bond process is like a giant game of Jenga,” said Kelly Dietrich, director of planning and development at The Howard Hughes Corp. “Every piece is a block in the tower. Start pulling out too many, like unexpected exemptions or revenue caps, and the whole structure can shift fast.”

As for Peak referencing an actual unnamed company that lost $5 million in bond reimbursements, Sinner welcomes that kind of blunt, open honesty at LIL events.

“A lot of conferences always talk about the great things; they never talk about the bad stuff. But how else are we going to learn?” said Sinner. “We want people to keep learning because the fewer mistakes we make, the better we all do.”