Aviator Howard Hughes built his legendary aerospace empire on a 1,086-acre tract within the western borders of Los Angeles known as Playa Vista. More recently, Hollywood turned Hughes Aircraft’s hangars into sound studios where scenes from blockbuster movies like Titanic achieved celluloid immortality. Big home builders had reason to believe the place was at least thrice-charmed. So, when a prolonged entitlement battle finally led to approvals for what will amount to 3,200-plus new for-sale homes—many of them mid-rise, four-to-five stories over a concrete podium—home building’s power elite practically stampeded over one another for a piece of the deal.

One of the key issues at stake in 2002: the chance under ideal conditions to test pilot production home building’s once and future diversification strategy du jour—urban village building, replete with high-rise, mid-rise, and attached townhouse offerings. Lots of big builders applied. When it came to Playa Vista, Shea Homes, The Warmington Group, Standard Pacific Corp., John Laing Homes, D.R. Horton, KB Home, and Lennar Corp, among others, got in. If Spruce Goose could get off the ground, why couldn’t an organization’s newly anointed urban division?

For veterans of the game, Playa Vista posed a seductive, if pricey, proposition, mostly thanks to its prime location within a stone’s throw of an oh-so compelling set of regional business and culture magnets, namely downtown Los Angeles and the beach. If you knew what you were getting into, it could work, if the project was managed carefully, built right, and marketed flawlessly. On the other hand, for initiates to urban infill’s erstwhile swelling ranks, the Playa Vista urban master plan proved, for three years at least, to act just like one of those overly forgiving teachers, willing to award undeserving performers passing grades. Playa Vista lured both proven and unproven urban builders in with a turnkey, pre-entitled, pre-designed land plan, and a real estate market that could move just about anything with walls, a door, and a deed to hand over.

Other downtowns would prove to be nowhere nearly so lenient in settling the score, especially after the end of 2005.

Hidden Dangers

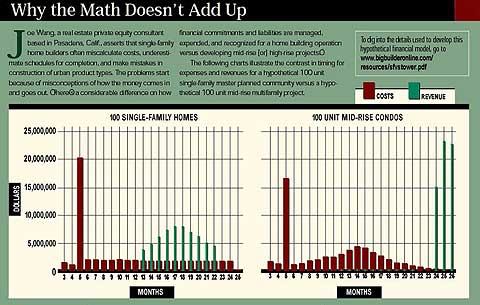

For about a three-year flash, competence seemed a moot point. Entering the arena, the faster the better, was all that counted. Price appreciation offset many of the painstaking details, the missteps, and the cost variances, just as a coat of paint covers a multitude of sins. At Playa Vista, a poster child for urban village building’s can’t-go-wrong theory, builders were said to be running $10 million to $15 million over budget on $50 million projects. Lucky for them, pricing outran their learning-curve ineptitude, as revenue variances came in at $20 million to the better on sales from $400 per square foot to $550 per square foot within the community over a two-year period.

Fact is, you only need to look back about 18 months to see loads of irony. Urban was to grow by hundreds of millions of dollars quantum leaps, year by year, during the 2006 to 2010 period, with many of the top 25 builders increasing their “attached” deliveries from single-digits to 20 percent of their unit closings.

Learn more about markets featured in this article: Los Angeles, CA.