Momentum in the housing market has moved solidly in the direction of home ownership. As of the fourth quarter 2017, Census data shows the U.S. has added more than 1.5 million home-owning households over the past year.

This change has stabilized and increased the national home ownership rate, from a cycle low of 63.1% in 2016 to 64% at the end of 2017.

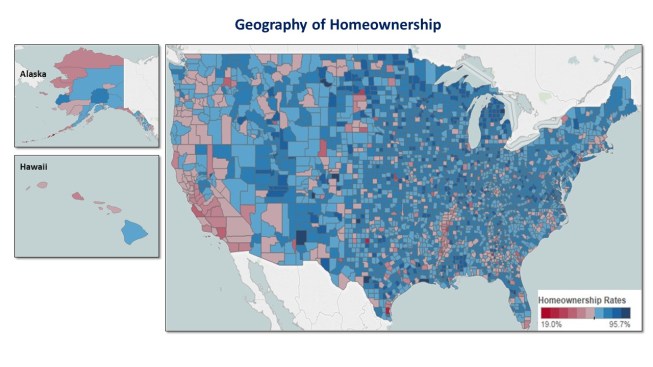

NAHB’s Economics team recently examined the factors that determine local home ownership rates to better understand how the market will evolve, as well as to identify policy that can promote home ownership as a civic benefit. County-level home ownership rates indicate there is a lot of variance depending on location. For a county with at least 5,000 residents, the top home ownership measure in the U.S. was Louisiana’s Cameron Parish, at almost 91%. The lowest two counties were in New York: Bronx County (19%) and New York City (23%).

Courtesy NAHB

Map of county-level homeownership rates by NAHB Economics.

The fact that two counties in the New York City metro area are at the bottom of the list gives a sense of how local rates vary. NAHB’s analysis scaled myriad variables—average age, marriage rates, and local housing costs and income—so that changes in these numbers produced equally likely results that allowed for examining their impact on local home ownership prospects.

The statistical analysis found that a 10 percentage point increase in the local marriage rate boosted the home ownership rate by 5.1 percentage points. Meanwhile, a decrease in typical housing costs by $75,000 added 4.1 percentage points to home ownership. More income also played a role: For every $10,000 gain in average household income, home ownership rates increased 0.6 percentage points.

This analysis has both policy and economic implications. Since home ownership is associated with benefits for wealth, health, education, civic, and other family and neighborhood outcomes, it’s clear that policies that promote home ownership are winners. Communities can promote home ownership by helping households develop roots in an area. This includes ensuring access to affordable rental housing while younger workers save for a down payment.

Economic and finance policies that promote marriage would also boost the prospects for home ownership, as would income growth. For example, the recently enacted tax reform legislation will increase after-tax incomes of most households and accelerate economic growth. Local governments can work to lower regulatory costs of developing land and building homes, and national policy can seek to reduce bureaucratic delays and other cost burdens imposed on residential construction.

Together, these policies will ensure access to affordable housing and facilitate more home ownership in the years ahead.