In March, Sage deemed market demand more secure, increasing his reading by 1 point, due to the fact that activity picked up a “notch” earlier in spring than in previous years. But the increase didn’t come without a disclaimer: “Builders are wary that it may not last, but they are enjoying it while they can,” according to Sage.

Philadelphia saw a point increase between its first and second composite score, but the raw score month-over-month decreased from a 7 to 6 in March, which could point to an iffy spring season as well. Although regional director Quita Syhapanya reported in February that traffic and new-home demand had gained traction and more qualified buyers were coming into the market, March was not as promising. “New-home demand is a bit off compared to the first half of February,” Syhapanya reports. “Traffic is still there, but sales are off a tick from last month.”

Western Markets Waver

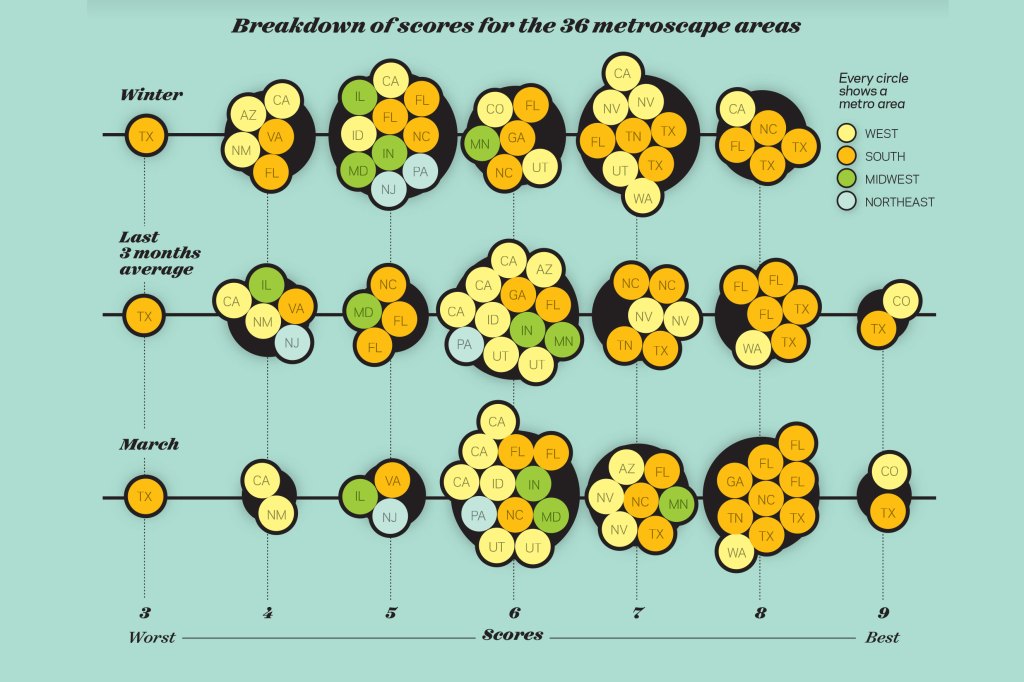

Demand levels in the 13 western markets showed more variation over the past six months than any other region in the U.S.—eight markets received a reading of 6 or above in winter, while 11 markets jumped to the upper range of the scale in the past three months.

Denver-Colorado Springs experienced the largest set back and rebound of any market in any region in the winter months, reaching a composite score of 9 the past three months and in March (along with Dallas-Fort Worth, the highest reading of all markets) from a composite score of 6 in the winter. Despite rising costs and a tight labor market bottlenecking major growth, regional director John Covert reported that “builders have experienced [the] strongest sales traffic and contract activity to begin the year since 2007.”

While every other market in the western region increased or remained above a 6 on our scale the past three months, the Albuquerque and Central California markets have stayed flat, with a low demand score of 4 the past six months. In both markets, employment is at the root of the problem—a lack of employment opportunities plagues Albuquerque, while Central California is slighted by buyer attraction to larger employment markets nearby.

“The resale market [in Albuquerque] has experienced modest recovery, but new-home demand won’t see much change until job growth materializes,” says Covert, noting that Pulte’s new community, Mirehaven, is the exception. It “includes a Del Webb age-targeted neighborhood that opened to large crowds and [stemmed] robust sales activity in February.”

Southern California didn’t fare well in the winter months either, dropping 2 points on the scale between the winter and three-month composite score. According to regional director Dennis Handler, the number of new construction transactions per month dropped off about 50% in the coastal counties since December 2014.

“Many builders have begun to lower prices to generate some sales traction and close the gap between average new and resale home prices,” Handler says. “Although subdivision traffic and contracts started January with an upward trend, the trend has since leveled off to about one contract per week.”

While the most notable markets are those either low or high on the scale, the majority (30 of 36 markets) of Metrostudy’s regions of coverage fall in the safe zone of 6 or above for new-home demand. This shows a lot of promise for the spring selling season, and we anticipate continued growth through the spring and summer.