LendingTree was out Tuesday with the findings of its study on the most popular metro areas for millennials seeking homeownership.

LendingTree analyzed new purchase mortgage requests nation’s 50 largest metros on its online marketplace from January to November 2019 and found that millennials are the primary home-seeking generation for more than half of the 50 largest metro areas in the US.

Like at other digital real-estate related enterprises, the study is based on in-house data and does not reflect actual sales or mortgage requests from other lenders.

Key Findings:

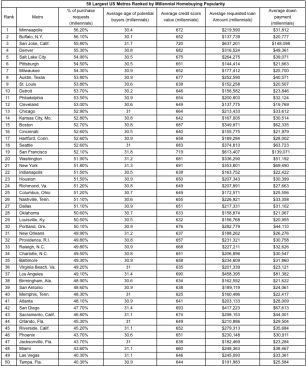

10 Most Popular Metros for Millennial Home Buyers – LendingTree Study

- Minneapolis, Buffalo, N.Y. and San Jose, Calif. are the metros where millennials make up the largest percentage of purchase requests. In Minneapolis, 56.2% of purchase requests came from millennials. In Buffalo, N.Y. and San Jose, Calif., the numbers are 56.1% and 55.8%, respectively.

- In Tampa, Fla., Las Vegas and Miami, millennials are making fewer purchase requests. Millennials made just 40.3% of the purchase requests in Tampa, Fla., and Las Vegas, and only 43.6% of the purchase requests in Miami.

- Millennial home buyers in San Francisco, San Jose, Calif. and Los Angeles are the oldest in our study. The average age for these three areas was 31.6 years old, nearly a year older than the average 30.8 across the remaining 47 largest metros in the country. These home buyers also face the highest average down payment amount.

- Buffalo, N.Y., Detroit and Minneapolis are the metros with the youngest potential millennial home buyers. The average age for these three areas was 30.2 years old.

- San Jose, Calif., San Francisco and San Diego are markets where potential millennial home buyers had the highest average credit scores. The average credit score for these three areas combined was nearly 711. By comparison, the average credit score for millennial home buyers across the 50 largest metros in the country was 658.

- Millennials in Oklahoma City, Louisville, Ky. and Memphis, Tenn., had the lowest average credit scores. Credit scores in these three areas were 633, 632 and 625, respectively.