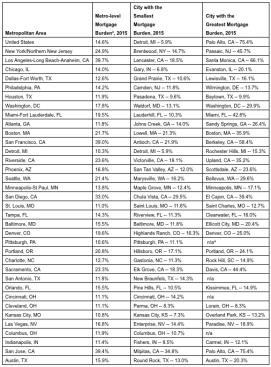

Even in metros where home buyers have the biggest mortgage burdens, some cities within those metros provide relatively affordable housing options, the real estate website Zillow reported Friday.

A prime example: In the San Jose metro, one of the hottest housing markets in the country where home buyers can expect to spend 75% of income on a house payment, in the city of Milpitas, just 15 miles away, buyers need only spend 35%.

Zillow’s latest research on mortgage burdens at the city level illustrates how hot spots within popular housing markets have caused runaway housing costs that place significant burdens on the people who live and work there, even as the cities next door remain more affordable. However, choosing a more affordable city likely requires trade-offs, such as fewer amenities or longer commutes.

“The Bay Area and other expensive West Coast markets get a lot of attention for being unaffordable, but even they have some areas where the share of income spent on housing is relatively low,” said Zillow Chief Economist Dr. Svenja Gudell. “Of course, buyers have to be willing to make some trade-offs to live in more affordable cities within the metro. Some cities in the most in-demand housing markets across the country have such a high housing burden that they are simply not feasible for buyers with lower incomes. If income growth doesn’t keep pace with home value growth, especially as mortgage rates rise, inequality will persist.”

In San Francisco, the flourishing tech industry and physical boundaries of the city have created a housing market with a high housing burden – buyers in San Francisco need to spend nearly 54% of their income on mortgage payments. Across the bay, homebuyers in Oakland fare a little better. Mortgage payments there require 42% of the typical household income.

Within the Seattle metro, Bellevue buyers would have to spend the greatest share of income on housing – 29.6%. Less than 10 miles away, Kirkland buyers only need to set aside 22% of income to pay their mortgage.

This phenomenon doesn’t play out in less heated housing markets. Buyers in almost any part of the Kansas City metro, for example, can expect to spend between 7.3% and 13.2% of income on a mortgage.

Similarly, buyers in the Las Vegas metro can expect to spend between 14.4% and 18.9% of income on mortgage payments, no matter which city they are in.

Buyers moving to the Detroit suburbs will have similar mortgage burdens, with buyers having to spend between 10.2% and 15.3% of income on mortgage payments. The city of Detroit itself has the smallest mortgage burden in the country – just 5.9% of the typical income needed to pay the monthly mortgage.