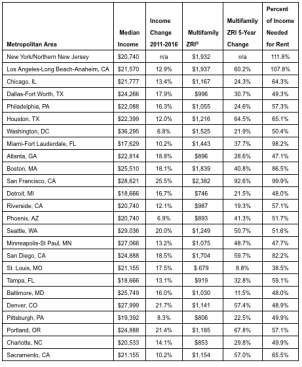

Renters who earn the least cannot afford even the cheapest market-rate rentals in the nation’s largest metro areas, according to a Zillow® analysis of multifamily rents and Census income data released Tuesday.

From 2011 to 2016, rents increased much more than incomes did, and this is especially evident at the lower end of the market. Even in markets where lower incomes saw significant gains, rents in those markets saw much bigger jumps. For example, the monthly earnings among the lowest third of incomes in San Francisco increased by about $485 between June 2011 and June 2016, but over that same time period, apartment rents grew $1,145.

“Any renter can tell you how difficult it is to save up extra cash while spending an increasing portion of their income on rent, but it’s much worse for those who make the least,” said Zillow Chief Economist Dr. Svenja Gudell. “Income inequality is growing in the United States, and this shows how high housing costs contribute to preventing people from moving up the ladder. There are several factors at play here, including wage growth dampened by the recession and increased demand on the rental market. Without a long-term solution to affordable housing, the gap between the haves and have-nots will continue to widen.”

The median rent for apartments in the least expensive third of the market required more than 100% of the typical income for the lowest-earning people who live in Los Angeles. People who are unable to get a housing subsidy likely must double up or move further from their jobs to find more affordable rents.