Where are we in the housing cycle?

Importantly, what does our specific answer to that question mean we should focus on in the Fall of 2017?

On a raw, historically-compared demand basis, there’s headroom galore, and many believe–with their investments, strategies and tactics–that market momentum has a strong, clear path at least to 2020, if not beyond.

Just released, the National Association of Home Builders/First American Leading Markets Index, notes that more than four out of five markets–282 metros–show Q3 improvement in a blended measure of single-family housing permits, employment, and home prices as a proxy for normalized demand. A top line analysis of that blend of data points from NAHB economist Danushka Nanayakkara-Skillington observes a well-recognizable pattern housing experts have been discussing for a while.

The LMI Score for the country as a whole reached 1.03. However, at 1.55, only the house price component is above 1.0. Meanwhile, the employment component sits at 0.99 and single-family permits are currently at 0.56. One interpretation of these metrics is that the slower recovery in housing supply coupled with strong demand is contributing to house price appreciation. At the same time, analysis of individual markets reveals that in areas where the overall economic fundamentals are strongest, permits have normalized, but in areas where the overall recovery is not as strong, the recovery of single-family permits represents a key challenge.

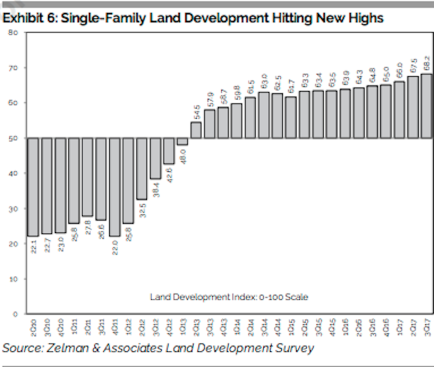

Forward momentum also comes through loud and clear in the rates of measure of demand for developed home sites. Zelman & Associates’ focuses part of its analysis in the current issue of The Z Report (for a free trial of The Z Report click here), on land acquisition and development activity.

With permission from Zelman & Associates.

The pace of development activity also continues to accelerate as builders and developers aim to expand community count in 2018. Our development index increased for a 10th consecutive quarter, reaching 68.2 on a 0-100 scale… … Nevertheless, in spite of the increased development activity, finished lot supply has continued to move lower, suggesting the pace of homebuyer demand has outpaced new supply coming to the market.

Recently, we heard this twist on an over-used analogy for where we are in housing’s recovery cycle: “We’re in the second inning of a double-header.”

Whether or not that may be helpful, that all-important second question at the top of this column calls for focus on two forms of capital as essential levers for viability and the ability to thrive tomorrow, human and money.

We will spotlight pathways forward on both forms of capital at Hive, an event coming up in just about 30 days in Los Angeles.

When we think about real estate investment capital–the lever of resources we need to take on lots, develop them, and create verticle value on them–we tend to bring predicate thinking to the process. We tend to think in traditional ways about how debt, equity, project, entity finance works. We tend to think in tautologies, that because this is the way things are done, that this is the way to do them. We tend to think that if some different way of approaching the same goal emerges, then it must be foolhardy or a misstep, or has been tried already and didn’t work.

At Hive, we’re trying to stir the pot on that type of thinking, because we believe that one of housing’s primary challenge areas–one that can add profitable opportunity to more firms engaged in housing’s business community–is to expand the market-rate universe.

That is, to build more structures and communities that would be attainable–as a function of household financial means–to a greater percentage of people.

To meet that challenge, we need to move past predicate thinking, which is a circular logic that rigs our housing system against its own ability to solve for today’s unmet needs and opportunities.

This is why now, in the concluding months of 2017, it’s important to hear what fintech innovator Eve Picker has to say about how people might think differently about attracting capital finance backing for housing initiatives that could well expand the market-rate universe.

Eve Picker founded Small Change on a business model and a belief. The business model sprang out of a policy initiative that bubbled up during the prior administration called the Jumpstart Our Business Startups (JOBS) program that allows entrepreneurial firms to clear Securities and Exchange hurdles to gain access to you-and-me investment money called “crowdfunding.”

The belief Eve brings to Small Change is that crowdfunding finance goes hand-in-hand with the DNA of housing’s entrepreneurial firms, bootstraps thinking and ingenuity.

From Eve, you’ll see and hear about real-world real estate and housing developments gaining access to democratized capital investment financing in a way that’s actually expanding the market-rate universe.

Want to begin to think differently about what housing’s enterprises, and collective talent, and infrastructure, and investment backing could do to both expand the market-rate universe of people and their access to profitable housing? Register today for Hive by clicking here.