This past Friday’s January 2018 employment report, with tidings of solid payroll headcount gains and continued upward pressure on household wages, cut both ways.

On one hand, the Bureau of Labor Statistics’ word of a spike in payroll employment and lowest unemployment rate since 2001 is a watershed moment in a jobs rebound off the Great Recession a decade ago.

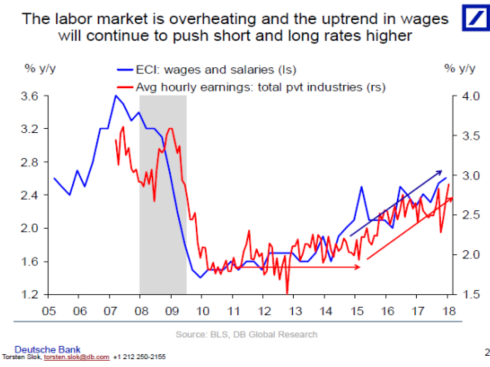

On the other, a sudden wall of worry has formed around wage inflation’s effect on short and long-term interest rates, as the Federal Reserve signals it will kick its switches and levers into action to tighten money supply and to try to keep inflation relatively in check. New York Times economics columnist and Nobel Prize winner Paul Krugman writes.

The wage gain strengthens the case that we really are near full employment; interest rates rose because the odds of Fed rate hikes to limit inflation have risen. And that hit stocks.

Deutsche Bank economist Torsten Slok charts similar upward pressure on interest rates as a result of momentum in wages. The good news for home builders and developers, however, is that Slok sees running room in the economy for a couple of years before a nearly inevitable downturn. He writes:

With wages trending higher, the FOMC needs to raise rates further to cool down the economy and cool down companies’ hiring and capex plans and ultimately revenue growth. And central banks, including the Fed, have a bad history of being able to gradually cool down the economy. Instead of a soft landing, it almost always results in a hard landing, i.e. a recession. For now, rates will go up by a lot more before the tightening in financial conditions ultimately results in a recession and lower rates, most likely in 2020.

Krugman’s view is that one or two months’ reports don’t a trend make, and he suggests it’s too early to see conviction in a long stretch ahead of “a low-growth rut.”

But the stock markets in the U.S. and now globally are an overreactive and overengineered collective of exchanges, and as Wall Street Journal staffers Riva Gold and Kenan Machado report, a worldwide selloff signals pervasive expectations of inflation and a rocket boost to government bond yields. Gold and Machado write:

Higher yields and rising inflation typically mean higher borrowing costs for companies and reduce the relative attractiveness of stocks compared with other asset classes. Longer term, tighter monetary policy can also crimp economic growth, which has underpinned much of the climb in stock prices over the past year.

Widely recognized in all this is the low, low base off which interest rates are getting pressure. If you want a sound analysis–the signal vs. the noise–of what the real outlook for home mortgage interest rates over the next stretch, National Association of Home Builders assistant VP for forecasting and analysis Michael Neal dissects the 30-year-fixed rate mortgage components here, concluding:

Since the last recession ended in June 2009, mortgage rates have been lower. The figure above indicates that the mortgage risk premium has remained about steady over this period. However, between June 2009 and the taper tantrum in 2013, the yield curve was flattening because the real yield was falling. After a steepening of the yield curve in response to the taper tantrum, which was shown to have pushed the real yield from negative territory to positive territory, the curve began to flatten, reflecting a combination of inflation compensation and the real yield at different points in time. More importantly, since 2015, the decline in the yield curve has largely offset the increase in the 3-month Treasury bill rate, a proxy for the federal funds rate. Today’s employment release indicates that short-term rates will continue to rise and it suggests that the yield curve may steepen, possibly combining to push up longer-term rates.

As with all things housing finance, higher borrowing costs impact both consumers and businesses on the acquisition, construction, and development lending fronts.

So, pay increases–especially among lower-paid workers–and increased take-home pay in most U.S. markets due to the $1.4 trillion Tax Cuts and Jobs Act are tailwinds supporting continued demand fundamental momentum in the housing market.

At the same time, higher monthly payments that would come not only from higher interest rates but higher home costs that reflect the pass-along of more expensive labor in the manufacturing and construction workstream may wipe out at least some of the gains households achieve through better wages.

Too, as we witnessed with the mid-2013 “taper tantrum,” the all-important consumer sentiment element showed itself to react negatively in a hypersensitive way to the suddeness of the unfavorable change, forgetting that the net result of the rise in rates was quite benign.

And further, given the delicate moment many builders–the ones who operate primarily off bank debt for project and AC&D financing–find themselves in with respect to their need to restock their lot pipelines soon to keep pace with demand after the next 18 months or so. the prospect of costlier money is a definite downer.

We see this as a motivator for some of those privately held company principals to draw a line somewhere between now and 2020 and say, once and for all, it’s time.