A “good year” in home building can come with strings attached. Momentum in demand among qualified buyers can make for a good year, even a very good year.

The “catch” comes when you look past that group of currently qualified buyers to those who intend to qualify themselves as buyers in the future, and the kinds of obstacles they’re having to overcome to become qualified.

Builders lose sleep when their ability to see a clear, steady stream of people making their way from “intending to qualify” to actually being qualified becomes impaired or clouded, by volatility, by uncertainty, by questions of what could interrupt or divert that stream.

Consumer confidence figures into the equation here, because people qualify themselves as home buyers not solely on financial resources they have, but what they’re figuring they’ll have to bring to bear on the obligations of ownership.

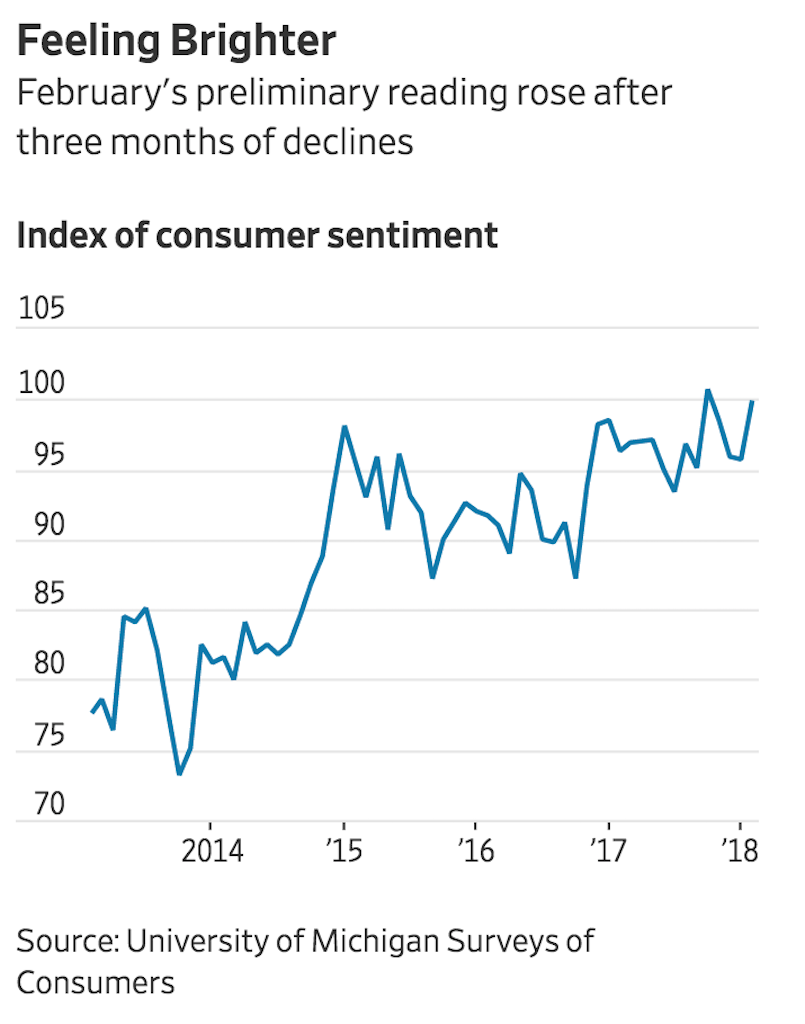

Now, consumer sentiment spiked early February preliminary readings, as the flush of tax cuts surged like an Adrenalin boost, and reversed what had been a downward drifting trajectory into a sudden upward leg.

This will be an important indicator to keep an eye on for two reasons. One, is that it’s a strong signal for consumers’ plans to spend more money, which could impact economic momentum in a virtuous circle of company profits, hiring, wage increases, and more spending. The other is that it’s a sensitive metric, prone to pivot swiftly on viral “animal spirits” psychological instincts. Collective economic attitudes and beliefs tend at times to take on their own life, not necessarily consistent with data fundamentals.

Wall Street Journal staffer Harriet Torry writes:

The rise in the latest index “may be the first sign of the boost to consumers from lower taxes and suggests that, even if consumption growth slows in the first quarter, spending will continue to grow at a solid rate over 2018 as a whole,” Andrew Hunter, an economist at Capital Economics, said in a note to clients.

Confidence buoyed by expectations that wages may have finally released themselves from the decades-long dead weight of inertia can work as a self-fulfilling prophecy. A contagious and ever-more-widely prevailing view both that one’s pay will go up and that more of it will come home in the paycheck rather than go to Uncle Sam will go up against a counter-force, also with potential to impact consumer sentiment.

The message of the counter-force delivers itself in the cost of things going up, those things including mortgage payments.

Here, CoreLogic research analyst Andrew LePage looks at a scenario that suggests a “typical mortgage payment” could increase by 15% in 2018. LePage does not resort to histrionics, even as he notes that the expected monthly payment impact–due to both rising prices and rising interest rates–will be material, rising from $804 in November 2017 to $910 by November 2018.

Relatively, LePage observes, that rise in monthly payments lands at a benign plateau, at least compared with when affordability in monthly payment terms hit a historic low point. He writes:

Figure 2 shows that while the inflation-adjusted typical mortgage payment has trended higher in recent years, in November 2017 it remained 36.4 percent below the all-time peak of $1,263 in June 2006. That’s because the average mortgage rate back in June 2006 was about 6.7 percent, compared with an average rate of 3.9 percent in November 2017, and the inflation-adjusted median sale price in June 2006 was $245,259 (or $199,900 in 2006 dollars), compared with a November 2017 median of $212,460.

Now, lots of experts quote historical data to show that people do not let rising interest rates derail their plans when it comes to buying homes, and quote survey data taken from people in the market today to support reasons for expecting history to repeat itself in light of historic trends.

But among builders we talk to, who have seen cycles come and go, and read past the economic “framing biases” that may isolate on an inappropriate time period or series of data points, many worry about a basic disconnect at work here.

They’re seeing their own cost pressures rising fast, and they’re seeing interest rates climb, and they’re not seeing too many conditions changing that are suddenly giving consumers more payment power. They worry at a basic level about their ability to deliver homes to a market for people who may not yet have entered the “qualified buyer” stream.

Will “animal spirits” prevail, causing people who “intend to qualify” to pull out the stops and do whatever it takes to enter the stream of people who can finance their Dream today? They’ll be looking at the upside of higher salaries and lower taxes against the downside of everything costing more, including the money they’ll need to borrow to pay for a home.

My guess is that historical models that look exclusively at interest rate movements and levels may be a red herring as a way to project consumer confidence and sentiment moving forward. Too many other important financial factors–health care and education costs, and other household priority items–are in dramatic flux and could sway both the psychology and the reality of household wherewithal.

So, 2018 will be a good year for builders to profitably meet demand among the currently qualified crop of declared buyers. But it will be an anxious one as those builders try to project how steady that stream will be among those who see themselves as on a track toward homeownership but don’t yet qualify.