The “lost decade” for housing ended by the end of 2017, as one of the surest signs of health in the marketplace was the dramatic decrease in signs of ill-health.

Now, when we use the term “housing crisis,” we revert to a once and future meaning of the expression: affordability and a shrinking of the talent base of people choosing housing as a livelihood.

Last week, CoreLogic economist Molly Boesel characterized a housing economic measure in a way we’ve seen for months now when it came to home price recovery in so many markets around the nation, but not when it came to measures of distress. In her “Loan Performance Insights” piece on October 2017 mortgage performance metrics, she noted that hurricane-impacted markets had seen a spike in delinquencies for the month, but that year-on-year, levels of distress had fallen to an 11-year low-point. She writes:

The foreclosure inventory rate, meaning the share of mortgages in some stage of the foreclosure process, was 0.6 percent in October 2017, down from 0.8 percent a year earlier. The foreclosure rate is back to the pre-crisis level of 0.6 percent.

Pre-crisis level.

We see more evidence of diminishing distress today from Attom Data Solutions’ Foreclosure Market Report, with commentary from Attom Data vp Daren Blomquist, who notes that foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 676,535 U.S. properties in 2017, down 27% from 2016, and down 76% from a peak of nearly 2.9 million in 2010 to the lowest level since 2005.

Blomquist does not use the “pre-crisis” term, but explains the trends this way (and the chart speaks for itself):

“Thanks to a housing boom driven primarily by a scarcity of supply, which has helped to limit home purchases to the most highly qualified — and low-risk — borrowers, the U.S. housing market has the luxury of playing a version of foreclosure limbo in which it searches for how low foreclosures can go,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “There are a few notable local market exceptions playing a different version of foreclosure limbo in which a backlog of legacy foreclosure activity left over from the last housing crisis is still winding its way through a labyrinthine foreclosure process, resulting in incongruous jumps in various stages of foreclosure activity in markets such as New York, New Jersey and DC.”

At the same time, mortgage credit availability is trending in a positive direction, as noted by the Housing Finance Policy Center at the Urban Institute here. The top line explanation for the improving trend is here:

The Housing Finance Policy Center’s latest credit availability index (HCAI) shows that mortgage credit availability rose from 5.1 to 5.6 percent in the third quarter of 2017 (Q3 2017), the highest level since 2013. This increase was mainly driven by the credit expansions within both the government-sponsored enterprise (GSE) and government channels, thanks to higher interest rates and lower refinance volumes.

The HCAI measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.

Mortgage credit availability in the GSE channel—Fannie Mae and Freddie Mac—has been at the highest level since its low in 2011.

Now for the part on what all this focus on declining distress, improved household wealth, and improving credit conditions means for builders in 2018 and why it matters.

For help on that front, let’s turn to the latest analysis from the ever-topical The Z Report, where the focus is on stars aligning around first-time would-be homeowners’ interests, actions, and financial qualification, which is fueling first-time buyer rates in a way that should sustain itself for some time.

The Z Report, for those who may not know, is a twice-monthly roll-up of a handful of exclusive analyses that expose opportunity, risk, and challenge, to investors, operators, and strategists in the single- and multifamily real estate space. You can try it out for free by clicking here.

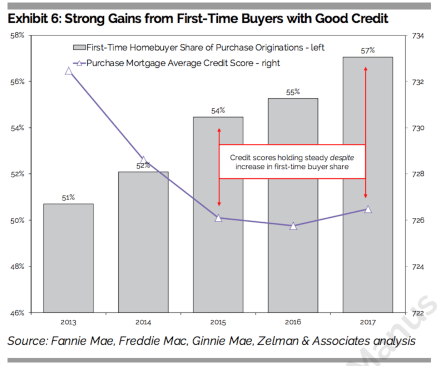

Net, net, the Zelman team concludes, the young adult cohort’s lag-time in household and family formation has given the group a collectively stronger credit foundation than they would have had earlier in the recovery cycle. The report notes:

“This speaks to the quality depth of potential first-time homebuyers that delayed family formation and/or the home purchase decision during and after the recession and are now in a sound position to move forward. To help frame the incremental opportunity, from 2000-07, sub-660 credit score homebuyers accounted for 15-20% of Fannie Mae and Freddie Mac securitizations and that share is closer to 3-4% today. It is not to suggest that the mix will return to those more lenient times, but we do believe that the entry-level market will benefit substantially over the next couple of years from young buyers that have good credit and delayed homeownership and more marginal credit borrowers that will benefit from expanding underwriting criteria.”

From our position, it looks as if the risks in 2018 will be the risks–cognitive, operational, and financial–of higher volumes. We think that despite ongoing muting effects of labor capacity volatility, production pace will pick up as more and more demand materializes on the lower-end margins of each market, and builders will be exposed to stress on their capital structures and financial management discipline.

Less distress on the home front translates into more stress on the home building front. This may be a catalyst for another wave of Mergers and Acquisitions activity in the months ahead.