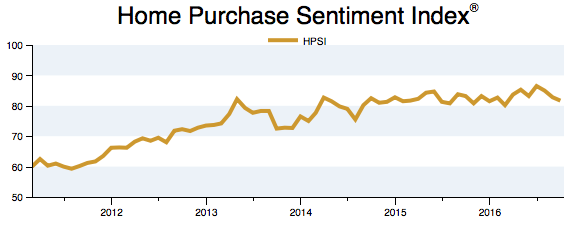

The Fannie Mae Home Purchase Sentiment Index® (HPSI) dropped another 1.1 points to 81.7 in October, the third decrease in as many months as consumer angst persisted.

Four of the six components that comprise the HPSI fell during the month. The share of consumers reporting significantly higher income over the past year experienced the largest drop, decreasing eight percentage points on net. The net share of consumers expecting home prices to go up in the next year fell three percentage points, and those who expect mortgage rates to drop and those who are confident about not losing their job each dropped by one percentage point in October. However, more consumers said they believe now is a good time to buy and a good time to sell a home – increasing two and four points on net, respectively.

“The HPSI fell in October for the third straight month from its record high in July, reaching the lowest level since March. Recent erosion in sentiment likely reflects, in part, enhanced uncertainty facing consumers today,” said Doug Duncan, senior vice president and chief economist at Fannie Mae. “Since July, more consumers, on net, have steadily expected mortgage rates to rise and home price appreciation to moderate. Furthermore, consumers’ perception of their income over the past year deteriorated sharply in October to the worst showing since early 2013, weighing on the index. However, this component of the HPSI is volatile from month to month, and the firming trend in wage gains from the October jobs report, if sustained, may foreshadow an improving view in the near future.”

Overall, the HPSI is down 1.5 points since this time last year. Details of this month’s survey:

- Partially reversing the decrease from last month, the net share of Americans who say it is a good time to buy a house rose by 2 percentage points to 31%. The share who think it is a good time to buy remained at an all-time survey low.

- The net percentage of those who say it is a good time to sell rose 4 percentage points to 19% in October, 1 percentage point away from the all-time survey high seen in July. The share who think it is a bad time to sell tied an all time survey low last reached in July.

- The net share of Americans who say that home prices will go up continued to fall in October, falling 3 percentage points from last month to 31%.

- The net share of those who say mortgage rates will go down over the next 12 months fell 1 percentage point to -45%.

- The net share of Americans who say they are not concerned with losing their job fell 1 percentage point to 69%.

- The net share of Americans who say their household income is significantly higher than it was 12 months ago fell 8 percentage points to 4%, the lowest it has been in more than three years.