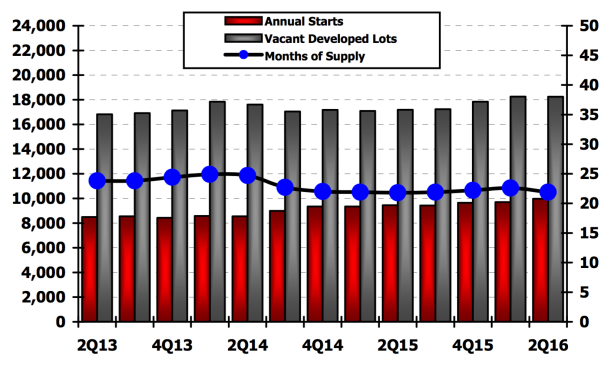

Metrostudy’s 2Q16 survey of the San Antonio housing market shows the annual rate of starts was 9,978 units, up 276 units from 1Q16 and a 5.6% increase over 2Q15. During 2Q16, there were 2,619 housing starts, up 11.8% compared to 2Q15. The annual rate of new home closings in 2Q16 totaled 9,347, a 0.2% increase compared to 2Q15 rate and down -0.3% from last quarter.

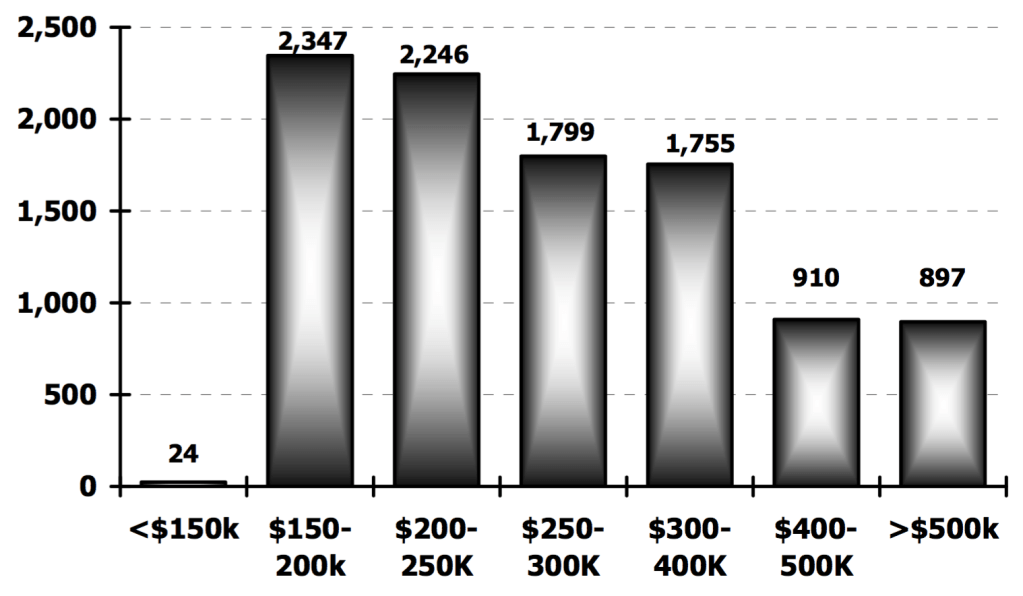

“During the second quarter, 53% of annual new single-family starts were priced above $250K, with 9% of those over $500K,” said Jack Inselmann, Director of Metrostudy’s San Antonio region. “New single-family homes in the $150K-$200K range represented 24% of starts, the $200K-$250K range took 24% of starts, and only 24 new single-family homes were priced below $150K, just 0.2% of annual starts.”

In 2Q16, Metrostudy recorded 18,241 vacant developed lots in the San Antonio market, a decrease of 12 lots from last quarter and up 1,056 over a year ago. Based on the current annual starts rate, this lot total represents 21.9 months of supply. Over the last twelve months the market delivered approximately 11,000 new lots. There were nearly 9,000 lots in the under construction pipeline at the end of the second quarter.

“Overall, San Antonio is in good shape with its inventory levels, however, concerns remain for the higher price ranges in some areas,” said Inselmann. “The sales pace in the San Antonio resale market was up 7.9% compared to 2Q15. This is an increase of 2,190 closings over the past year. The resale market is also seeing pricing increases, as the average price of sales for the twelve-month period ending 2Q16 was $233,113, up 4.2% from 2Q15.”

For further analysis of the San Antonio market, contact Metrostudy senior regional director Jack Inselmann: jinselmann@metrostudy.com