Many prognosticators have contributed their thoughts to the state of the housing industry this year. We recently caught up to Kermit Baker, chief economist at AIA for his thoughts, and they match the majority: Onward and upward.

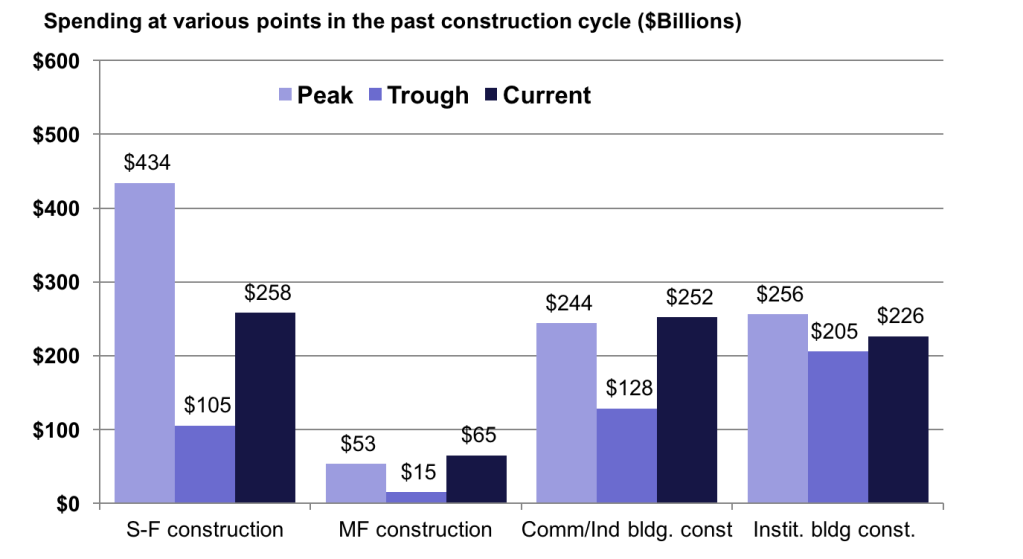

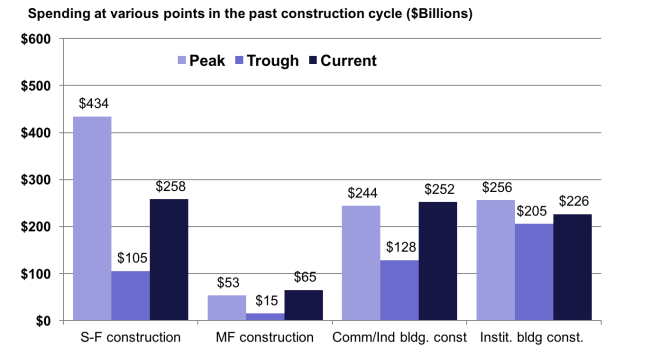

Baker says that construction recovery is now underway and is boasting healthy numbers, which of course varies from sector to sector. However, with single-family residential there was a very steep decline during the recession, reaching nearly 75%. Baker adds that since the recovery started, we have had healthy growth that is leading to lots of opportunity.

U.S Census Bureau Construction Spending Put-in-Place

Current as of February 2017.

With multifamily, Baker says there are many more renters, a strong construction market, increases in rents, and growth in property values. But, Baker warns that these healthy days for multifamily are going to start winding down. He attributes that partially to the fact that average property values are 50% greater than they were during the peak.

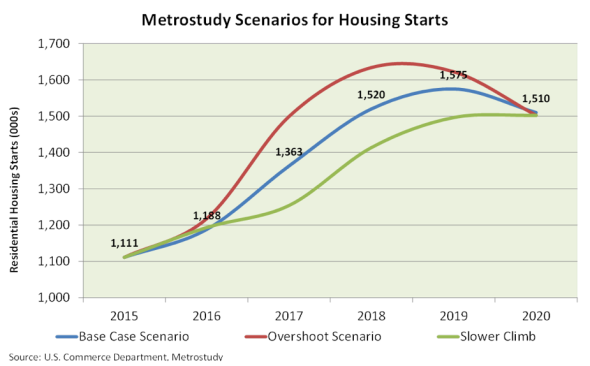

Metrostudy’s Regional Director David Cobb adds that builders are facing challenges today that will slow down the recovery, including rising interest rates, high land costs, labor shortages, increasing material prices, rules and regulations, and an overall difficulty in meeting first-time buyer price points.

And, just as Baker points out, Cobb says that there is plenty of opportunity for single-family residential growth. These opportunities may be the result of improved employment during the next five years, plus a rising median household income.

Cobb also says that we aren’t at the end of the cycle, but we may be closing in on it. Cobb shares that Metrostudy’s base case scenario for housing starts would be a relatively slow climb to 1.575 million in 2019.

U.S. Commerce Department; Metrostudy

He warns that careful research and accurate data analysis will never be more than important than during the current cycle.