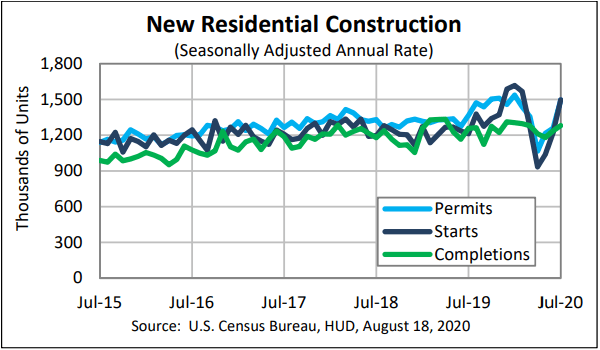

The U.S. Census Bureau and the Department of Housing and Urban Development jointly announced the July data for new residential construction on Tuesday with an abundance of increases across the board.

Privately owned housing starts in July were at a seasonally adjusted annual rate of 1,496,000, which is 22.6% higher than the revised June estimate of 1,220,000 and is 23.4% above the July 2019 rate of 1,212,000. Single-family housing starts were at a rate of 940,000 last month, an 8.2% increase from the revised June figure of 869,000. The July rate for units in buildings with five units or more was 547,000.

Privately owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,495,000, which is 18.8% above the revised June rate of 1,258,000 and is 9.4% above the July 2019 rate of 1,366,000. Single-family authorizations in July were at a rate of 983,000, a 17% increase above the revised June figure of 840,000. Authorizations of units in buildings with five units or more were at a rate of 467,000.

Privately owned housing completions in July were at a seasonally adjusted annual rate of 1,280,000. This is 3.6% above the revised June estimate of 1,236,000 and is 1.7% above the July 2019 rate of 1,258,000. Single-family housing completions were at a rate of 909,000 last month, a small 1.8% decline from the revised June rate of 926,000. The July rate for units in buildings with five units or more was 364,000.

“The year-over-year increase in permits, starts, and completions indicates that builders are eagerly responding to record low mortgage rates, a limited supply of existing homes for sale, and sturdy demand driven by millennials aging into homeownership, but rising material costs may dampen that momentum in the months to come,” says Odeta Kushi, First American deputy chief economist. “Prior to the pandemic, builders were already faced with several supply-side headwinds. Those headwinds remain, but builders must also grapple with surging lumber prices, which have more than doubled since April.”

Doug Duncan, chief economist at Fannie Mae, also points out “single-family new-home sales in recent months have outpaced their usual relationship to starts. Home builders have supported sales by drawing down existing inventories of homes previously started. An acceleration in new construction was therefore expected in order to rebalance this relationship in light of continued buyer demand. However, the pace in July of 940,000 annualized units exceeded our Q3 forecast average pace of 904,000 units. Given that single-family permits jumped by an even larger 17% over the month to the second highest level since 2007, a strong rate of construction will likely continue in August, and our near-term forecast will be revised upward.”