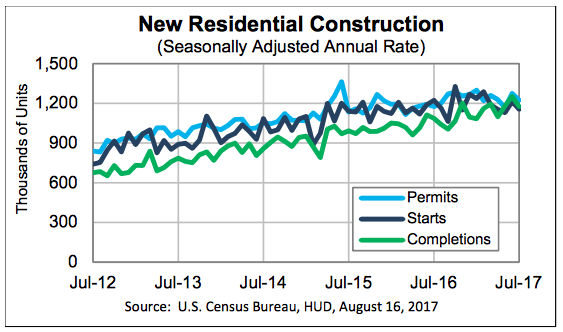

Privately-owned housing starts in July fell 4.8% from June to a seasonally adjusted annual rate of 1,155,000, 5.6% behind the pace of July, 2016, the Commerce Department reported Wednesday.

The drop in starts was primarily driven by 17.1% decline in multi-family construction, itself due to big declines in the Northeast and Midwest. Single-family housing starts in July dropped 0.5% to a rate of 856,000, a healthy 10.9% ahead of the pace of July 2016.

Single-family starts in the Northeast were up 9.8% from June and 13.6% from last July, down 7.4% from June but up 16.7% in the Midwest, up 2% and 8.2%, respectively, in the South, and down 4.3% sequentially but up 12.9% in the West.

The multifamily swoon also took down overall permit numbers. Building permits in July were at a seasonally adjusted annual rate of 1,223,000, 4.1% below the revised June rate of 1,275,000 but 4.1% above the July 2016 rate of 1,175,000. Single-family authorizations in July were at a rate of 811,000, unchanged from the revised June figure of 811,000.

Regionally, single-family permits were down 1.8% and 3.3% from June in the Northeast and Midwest, respectively, with the South rising 1.6% and the West falling 1.1%. All regions were up year-over-year, the Northeast by 9.8%, the Midwest by 9.4%, the South by 14.4% and the West by 12.7%.

Housing completions in July were at a seasonally adjusted annual rate of 1,175,000, 6.2% below the revised June estimate of 1,252,000 but 8.2% above the July 2016 rate of 1,086,000. Single-family housing completions in July were at a rate of 814,000, 1.6% below the revised June rate of 827,000.

Lawrence Yun, chief economist at the National Association of Realtors, was not pleased with the declines. In a prepared statement, he said, “The housing shortage in America will intensify if new construction remains as lackluster as it was in July. The softening multifamily housing starts brought down the overall new housing unit additions to the second lowest monthly activity this year. Moreover, the latest 15% drop in multifamily housing starts and 0.5% drop in single family starts will hold back economic growth potential. Because of this continued shortage, expect rents and home prices to rise by at least twice as fast as the broad consumer price index.”