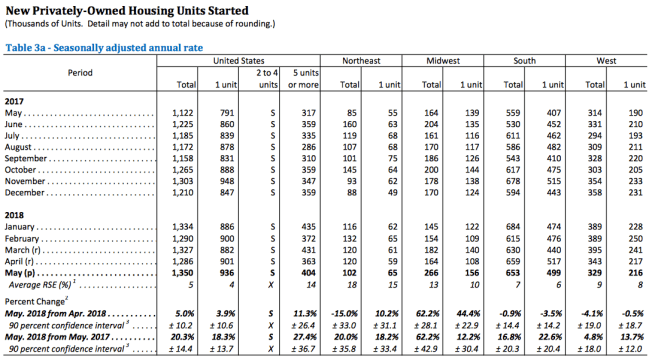

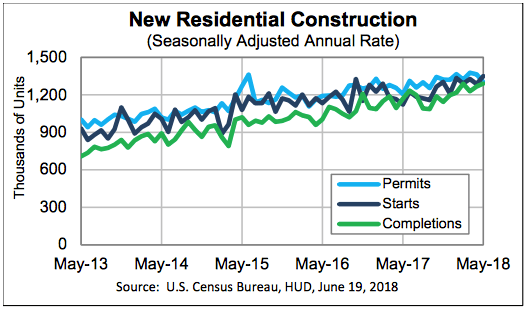

Housing starts in May rose 5% from a revised April estimate to a seasonally adjusted annual rate of 1,350,000, 20.3% above the May 2017 rate and a 10-year high, the Commerce Department reported Tuesday. Single-family housing starts in May were at a rate of 936,000, 3.9% above the revised April figure of 901,000 and 18.3% ahead of a year earlier. The May rate for units in buildings with five units or more was 404,000.

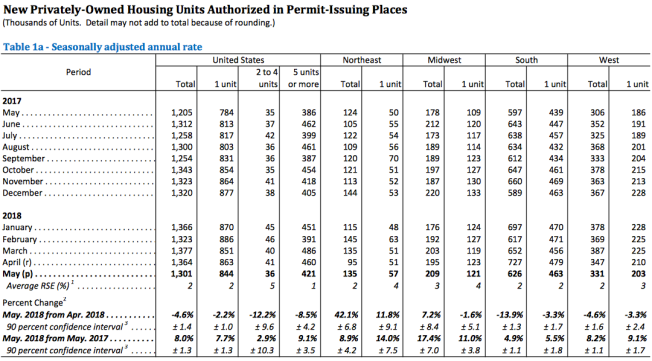

Building permits in May dropped 4.6% from April to a rate of 1,301,000 but remained 8.0% above the May 2017 rate of 1,205,000. Single-family authorizations in May were at a rate of 844,000, 2.2% below the revised April figure of 863,000 but 7.7% ahead of May, 2017. Authorizations of units in buildings with five units or more were at a rate of 421,000 in May.

Housing completions in May were at a seasonally adjusted annual rate of 1,291,000, 1.9% above the revised April estimate of 1,267,000 and 10.4% above the May 2017 rate of 1,169,000. Single-family housing completions in May were at a rate of 890,000, 11.0% above the revised April rate of 802,000. The May rate for units in buildings with five units or more was 389,000.

“The construction market continued to improve in May, with permits – a good comparison indicator of building – up 8% from a year ago,” said Freddie Mac Chief Economist Sam Khater. “Over 40% of the rise this year is being driven by booming Western markets (up 15.1% so far this year). The pipeline of units under construction rose 5.3% from a year ago, and is at the highest level in nearly 11 years. While the rise is good news, it’s still not enough for a hot real estate market that is starving for inventory during the peak summer sales season.”

Lawrence Yun, chief economist at the National Association of Realtors, was similarly upbeat on the news. “New home construction activity soared to its highest level in over a decade, which is fantastic news as more housing inventory will be available as the year proceeds,” said Yun. “Moreover, construction and real estate industry jobs are being created and boosting the economy. GDP growth of 4% to 5% is possible in the second quarter, as a result. The Midwest region experienced the biggest gain and hence the region will remain more affordable. The more unaffordable West region will continue to experience an intense housing shortage, as both housing permits and housing starts fell in that region. For the country as a whole, an additional 20% to 25% gain in home construction is needed to make the market more balanced.”