If you’re one of those people who believe all good things must come to an end, then you’re probably wondering how much longer can this economic recovery and the housing market rebound last?

It’s a good question since the current economic expansion is the second longest in almost 200 years. It’s lasted 36 quarters, second only to the 40-quarter expansion from 1991 to 2001. The stock market has climbed an inflation-adjusted 150% since 2010, and single-family housing starts have increased every year since 2011; that’s the longest winning streak since at least 1980.

The median sales price of a new single-family home has increased annually since 2011 and is now higher than the previous peak in 2005. As a result, according to Core Logic, the share of homeowners with negative equity mortgages is less than 5%, down from 26% in 2009. And the Mortgage Bankers Association notes the foreclosure rate has dropped to 1.2%, which is in line with pre-crash levels. But now what?

Supply and demand suggests that housing’s winning streak should be far from over. On the supply side—even though single-family starts have increased every year since 2011, and multifamily activity has been robust for the past five years—total annual starts haven’t even averaged 1.2 million units this decade. (At an average of 691,000 units since 2011, single-family starts are well below their long-term annual average of 1.1 million units.) On the demand side, the combination of household formations, existing homes lost to demolition, and second-home purchases creates annual demand for 1.6 million new housing units. With millennials forming households and settling into decent jobs, demand is expected to stay strong for at least five more years.

So, as it is right now, there is a housing shortage. According to Harvard University’s Joint Center for Housing Studies (JCHS), in roughly one-third of 93 large metro areas, the supply of homes for sale averages less than two months, which is well below the six months considered to be a balanced market.

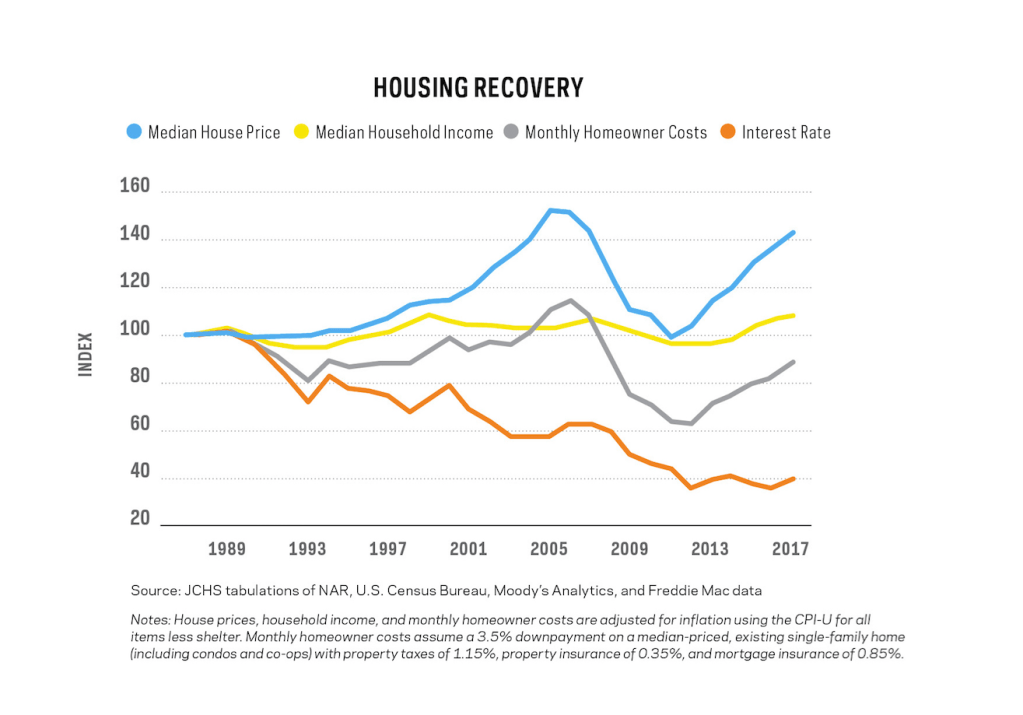

This chart from the JCHS 2018 State of the Nation’s Housing report shows that the housing recovery has been sustained by constantly falling and historically low mortgage interest rates. Meanwhile, median home prices have soared and median incomes have stagnated, which would’ve been a disaster for the housing market. But because rates fell so much, monthly homeowner costs have remained reasonable, demand is healthy, and your business is pretty good.

Now, rates are rising: They’ve moved from 3.65% in 2016 to about 4.5% today. If they reach 5% by year end, as expected, and home prices keep climbing, the typical homeowner’s monthly payment would increase to $1,839.

That’s not the end of the world, but it could mean that sooner or later into every builder’s life a little rain can be expected to fall. So why not grab an umbrella and start to build lower–priced houses now?