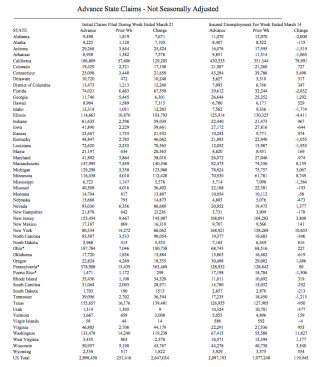

The Labor Department reported initial jobless claims surged In the week ending March 21 to 3,283,000, an increase of 3,001,000 from the previous week’s revised level.

This marks the highest level of seasonally adjusted initial claims in the history of the seasonally adjusted series. The previous high was 695,000 in October of 1982.

The department said states continued to cite services industries broadly, particularly accommodation and food services. Additional industries heavily cited for the increases included the health care and social assistance, arts, entertainment and recreation, transportation and warehousing, and manufacturing industries.

Mike Fratantoni, senior VP and chief economist for the Mortgage Bankers Association, reacted with this statement:

“Last week provided our first indication of just how severe the shutdown of the U.S. economy could be, as Americans combat the ongoing spread of the coronavirus. With respect to the job market, the Labor Department this morning announced that almost 3.3 million Americans filed for unemployment last week – an increase of three million compared to the prior week. These layoffs will lead to real hardships for millions of households across the country.

“Mortgage servicers are already hearing from a substantial number of homeowners who are concerned about their ability to make their mortgage payments on time. The mortgage industry is ready and willing to help through the use of established forbearance programs, allowing borrowers who have lost their jobs or been furloughed as a result of the virus the ability to delay their payments for at least six months.

“However, the unprecedented and unexpected wave of forbearance requests will place a significant strain on mortgage servicers. Even if a quarter of all borrowers request forbearance for six months or longer, cash demands on servicers could exceed $75 billion and could climb well above $100 billion.

“That is why it is absolutely critical for the Federal Reserve and U.S. Treasury to immediately establish a liquidity facility so that otherwise solvent mortgage servicers can borrow from the Fed to support these forbearance programs. This needed backstop for servicers will ultimately support homeowners during these challenging times.”