Metrostudy’s 2Q16 survey of the Dallas Fort Worth housing market shows that compared to the first quarter of 2016, new home starts were up, but not as elevated. During the past twelve months, builders started 29,580 homes, of which 7,215 started in the second quarter. This quarter’s starts represent an annual increase of 23.8% and when comparing 2Q16 to 2Q15, the increase drops to 2.5%. The rain days this quarter contributed to sluggish starts numbers. Of the 91 days in the second quarter, the National Weather Service reports that 32 days had notable rain. Although the weather shouldn’t impact new home and lot delivery in DFW as severely as 2015, it will hamper lot and home deliveries this year.

Quarter-over-quarter, starts remained relatively flat with a 1.8% increase over 1Q16. Dallas-Ft. Worth builders closed 25,884 homes annually through the second quarter, 13.5% more than 2Q15. Starts and closing are expected to remain steady for the remainder of 2016. As such, Metrostudy forecasts between 30,000 and 31,000 annual starts and 26,500 annual closings in DFW for 2016.

“The second quarter survey reflects a radical shift from lower new home prices, which now includes the segment from $200,000 to $249,999,” said Paige Shipp, Regional Director of Metrostudy’s Dallas-Ft Worth region. “Over the past two years, starts below $200,000 decreased dramatically while starts between $200,000 and $249,000 remained relatively flat or slightly increased. This quarter, starts in that price tranche dropped 19.3%, which signals a possible extinction of new homes below $250,000 in DFW. The surge in closings is most evident in the $250,000 to $299,999 and $500,000 to $749,999 price ranges where closings outpaced starts by 19.8% and 16.8%, respectively. “

Metrostudy’s field surveyors reported an increase in completed or built-out communities this quarter. The communities opening in 2016 consist of next-generation lot pricing.

New lot prices are significantly higher than the legacy lots and will translate to exponentially more expensive homes. Buyers will be surprised at the price escalation and may not want to, or be able to, afford the higher prices of these new homes.

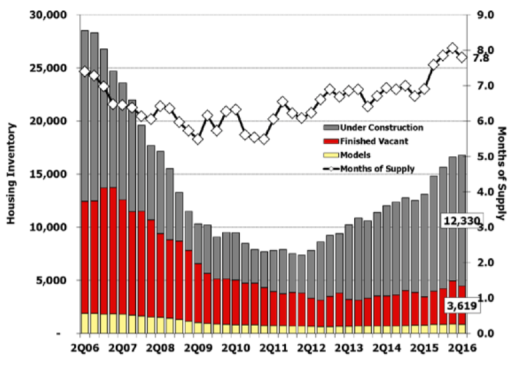

The second quarter of 2016 revealed the first decrease in total inventory and finished vacant inventory in four quarters. Since the beginning of 2015, inventory has been steadily increasing as a result of labor constraints and weather related delays. Total inventory this quarter dropped to 7.8 months of supply from 8.0 months of supply in 1Q16.

Finished vacant inventory, homes completed by not occupied, dropped from 2.0 months of supply to 1.7 months of supply. This decrease represents builder’s discipline in starting and closing speculative inventory as well as closing homes as soon as they are completed. The most striking drop in finished vacant inventory occurred between $200,000 and $299,999. The number of units available dropped 21.6% or 243 units. As noted previously, homes priced above $400,000 have the highest months of supply. However, the months of supply hovers around 2.0 to 2.5, or equilibrium.

As we enter into the second half of the year, builders’ greatest concerns are rising costs, the highest of which is land, and compressed new home price appreciation. In comparing their profit margins to rapidly appreciating home prices, builders note that virtually all of the price appreciation covered increasing costs. Essentially, the increased costs were passed directly to the buyer and did not contribute to higher builder profit margin. As the the Dallas-Fort Worth new home market experiences price appreciation deceleration, builders worry that their margins may decrease over the coming months.

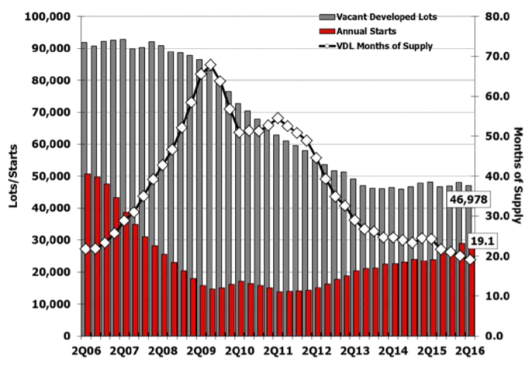

Total single-family detached and townhome lot inventory dropped for a sixth consecutive quarter to 19.1 months of supply from 19.9 months last quarter. New lot deliveries for 2Q16 were 2.5% lower than 2Q15, most likely due to weather delays, but annual starts increased 23.8%. Developers grow increasingly frustrated with labor related delays. Currently, they report franchise utilities (electricity and gas) as their major holdup. The electricity companies have a short list of approved contractors and installers and the approved contractors are not providing enough workers to meet development demands. Other labor constraints include the engineers that design the communities and municipalities that approve and inspect new home communities.

“Builders appear to have reached a pivotal phase where they exhausted their less expensive, legacy lots and are transitioning into more expensive, next-generation lots,” said Shipp. “Historically, Dallas-Fort Worth developers and builders choose to create communities in top submarkets with the best schools. However, land and lot prices in those markets prevent builders from delivering affordable homes. The new home industry in the market must recognize that many buyers strive for homeownership, and they will sacrifice location and school quality to own a home. Until that occurs, builders will continue to deliver new homes priced above what the average homebuyer can afford.

For further analysis of the Dallas-Fort Worth market, reach out to regional director Paige Shipp: pshipp@metrostudy.com