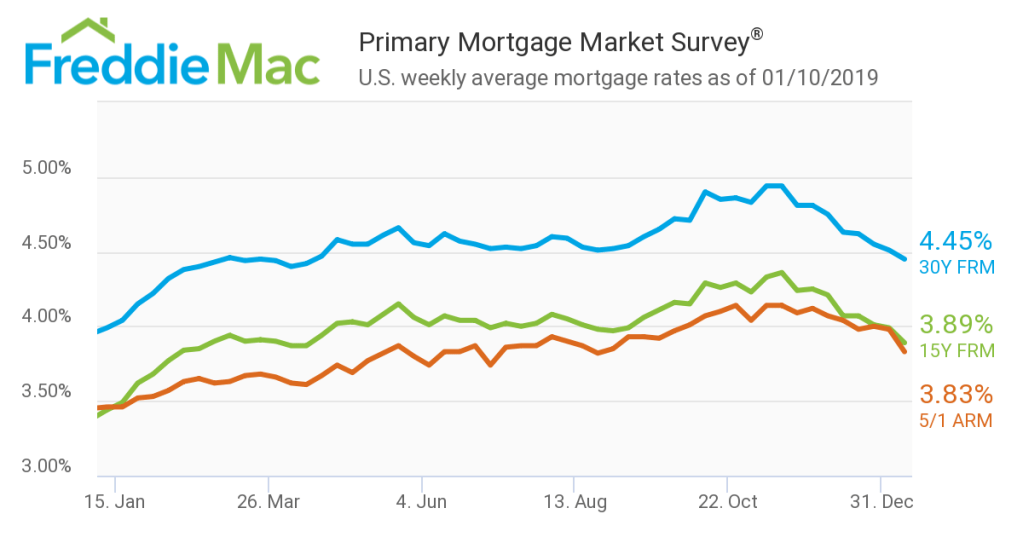

Freddie Mac’s (OTCQB: FMCC) Primary Mortgage Market Survey® , out Thursday, shows rates dropped significantly across the board.

Sam Khater, Freddie Mac’s chief economist, said, “Mortgage rates fell to the lowest level in nine months, and in response, mortgage applications jumped more than 20%. Lower mortgage rates combined with continued income growth and lower energy prices are all positive indicators for consumers that should lead to a firming of home sales.”

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 4.45% with an average 0.5 point for the week ending January 10, 2019, down from last week when it averaged 4.51%. A year ago at this time, the 30-year FRM averaged 3.99%.

- 15-year FRM this week averaged 3.89% with an average 0.4 point, down from last week when it averaged 3.99. A year ago at this time, the 15-year FRM averaged 3.44%.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.83% with an average 0.3 point, down from last week when it averaged 3.98%. A year ago at this time, the 5-year ARM averaged 3.46%.