Declining opportunities for remote work and the geographic flexibility it offered employees, combined with rising insurance costs, high interest rates, and the lingering rate lock-in effect helps explain slowing migration to many previously booming Southern markets.

Sam Williamson, Senior Economist, First American Title Homebuilder Services

What this new normal means for home builders is a topic of deep interest to Sam Williamson, a senior economist at First American, a premier provider of real estate title, settlement and risk solutions. It’s his job to analyze, forecast and comment on U.S. residential real estate and mortgage trends.

What does a less-mobile population mean for home builders? The senior economist recently offered his insights on a changing marketplace.

How would you characterize the housing market today?

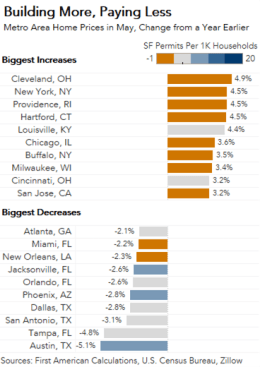

Today’s housing market is mixed—hot in some places, cool in others. In the Northeast and Midwest, prices are still rising as limited supply keeps competition high. But in the South—especially in places like Texas and Florida—prices are flat or falling as more homes come on the market.

New construction plays a major role in this divide. Home builders have been far less active in certain parts of the country than others. Good examples are the Northeast and parts of the Midwest and West. In contrast, construction surged in major markets in Southern states like Texas, Florida, Georgia, and Arizona during the pandemic boom.

Meanwhile, existing-home sales make up a smaller slice of the total home sale pie, dropping to just 84%, the lowest level since 2005. Many homeowners are reluctant to part with their low mortgage rates, knowing their next mortgage would double or triple their house payment. Fortunately, home builders still have advantages in this market, even as it cools in formerly booming areas.

What conclusions can you draw from regional home sale numbers?

Let’s start with the Southern markets. The slowing pace of migration, coupled with rapid construction, has seen supply outpace demand and led to softening home prices in once-booming markets like Austin, Tampa, Dallas, Orlando, and Atlanta. Faced with a growing surplus of newly built homes, builders are increasingly relying on incentives like buy-downs, flexible pricing and design perks to spur softening sales.

Contrast those conditions with markets in Northern states like Ohio, New York, Connecticut and Illinois, where limited new supply and a scarcity of desirable listings are fueling competition among buyers. We’re seeing stronger price appreciation in Cleveland, New York, Providence, Hartford, and Chicago. Even with slower home building in some areas, builders are gaining a larger share of overall sales—a sign that demand is still there. But to reach buyers, they have to meet them where they are, both in terms of price and location. Nimble builders are adjusting by offering smaller, more affordable homes. Applying that playbook in markets where supply remains constrained could unlock new opportunities.

Where do you see the market headed?

This year was a time of recovery, with inventories nationwide improving to about 10% below pre-pandemic levels.

I’m cautiously optimistic existing-home sales will slowly start to recover from today’s levels. Barring unforeseen circumstances, mortgage rates are widely expected to drift lower toward the end of 2025 and incomes should continue to grow, modestly improving affordability heading into next year, which would provide a stronger foundation for growth than a year ago.

The migration trends witnessed during the pandemic are cooling, if not reversing. This may be a good time for builders to turn their attention to the Northeast and Midwest. There’s been less construction there. Inventory remains significantly below pre-pandemic levels. Builders can take what they learned from pandemic boom towns and apply it there.

Overall, the outlook for new residential construction is encouraging—for agile builders willing to stay flexible and meet buyers where they are financially and geographically.

Learn more about First American Title’s outlook on residential and commercial real estate.