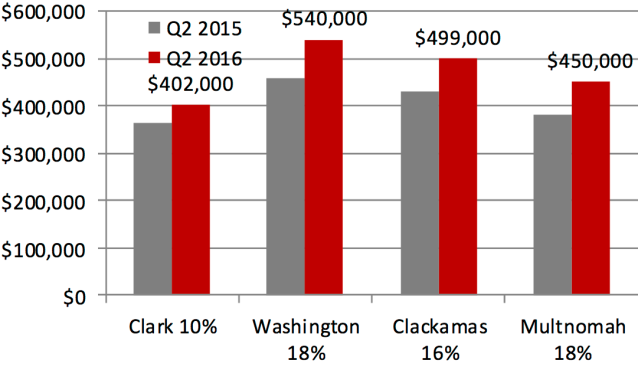

Metrostudy’s 2Q16 survey of the housing market in Portland shows that inventory in the region is at critical lows and is causing price points to climb at double-digit rates. The median available asking prices have crested over $400k for Clark County and near $550k for Washington. It is evident by the slowing sales volume and the median closed sales prices being roughly $75k under what the asking price is today for a new home that the price points are beginning to have a negative effect on the market.

We currently have little supply and have had high demand, but that demand is shrinking as it becomes less affordable to own a home in Portland.

“It’s Econ 101: supply and demand,” said Todd Britsch, Regional Director of Metrostudy’s Portland region “We currently have little supply and have had high demand but that demand is shrinking as it becomes less affordable to own a home in Portland. Much like Seattle, Portland has seen a significant amount of new high paying jobs in the Tech sector. While the Tech sector will remain strong for the foreseeable future the hiring frenzy may be coming to an end or at least slowing.”

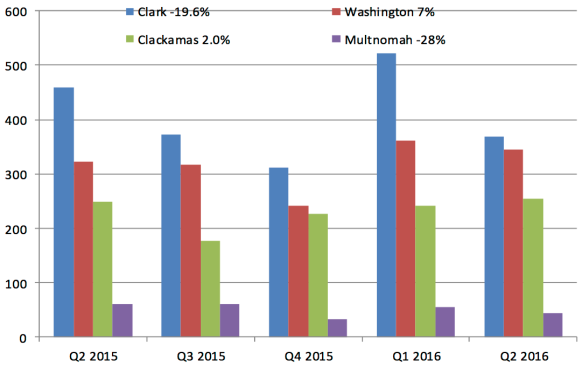

While Clark county has been leading the region with new home sales growth for the past 4 years. This is the first time since 2011 that we have seen a decline in quarter over quarter sales comparisons. The decline was quite significant at -19.6%. Q2 2015 Clark County yielded 459 new homes sales compared to 369 in Q2 of 2016. While Multnomah County declined -28% this decline only represents 11 total sales. Multnomah Counties infill new construction seems to still be flourishing.

The region as a whole is down 7% in sales volume driven by the steep decline in Clark County. The median list price for available inventory continues to climb at double digit appreciation, ranging from 10% in Clark County to an 18% increase in Washington County during the past year. Portland as a whole may have reached the point where it has finally out priced the mortgage market. While there has been strong in‐migration and strong demand for the past 36 months, the median new home asking price is reaching near $500k for the region and it is having a negative affect on buyers.

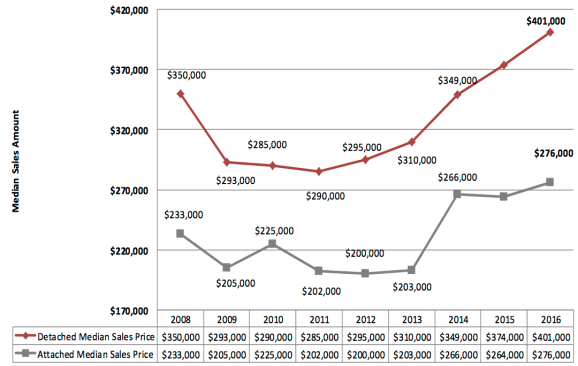

“Since the beginning of the recovery the median closed sales price for a single-family home in Portland has risen 36% from $285k to $401k,” said Britsch. “If we substitute the median closed price for the median asking price of $500k, that increase is 75%. While prices will continue to rise for the next year due to lack of buildable land, we will see single-family home sales decline. Even with the median closed price for multi‐family rising 38% since 2012 to $276k the average list price of a townhome is still under $300k offering an affordable option for a first time home buyer. The region needs more fee simple affordable townhomes priced under $300k.”

Current Inventory levels are still critically low which is part of the reason home prices have risen so dramatically. A healthy inventory level should be 20 months of vacant lots and under 4 months of unsold spec inventory. No county has more than a 15-month supply of lots and Washington County is the on one with a slightly high spec count. It is important to note that if sales slow 10% to 15% the months of supply will rise. This will again continue the trend of selling twice as many homes than we are replacing with new lot inventory. Until we have a larger supply of finished lots prices as seen will continue to rise.

For further analysis of the Portland market, reach out to regional director Todd Britsch: tbritsch@metrostudy.com