Metrostudy’s 2Q16 survey of the Seattle housing market shows that the first signs of the slowdown have begun to show up: slowing job growth along with a dramatic change in migration numbers. While we have a significant amount of pent up demand and two months of not so positive data does not constitute a trend, it is something to be aware of. Often times a slowdown can be hidden in the seasonal change. As we head into the fall and begin to see our normal adjustment to less foot traffic along with fewer contracts written it may be time to adjust your game plan. If the same trends continue to occur we could see a 15% drop off in volume in 2017 and a severe adjustment in pricing to capture those that are still in the buying pool.

While we still have a significant amount of pent up demand for housing, this quarter’s numbers seem to be the first sign of a slowing market to come.

“The state’s in‐migration has hit negative numbers for the first time in over 4 years,” said Todd Britsch, Regional Director of Metrostudy’s Seattle region. “April and May both saw a net negative state migration totaling –3,457 people. While we still have a significant amount of pent up demand for housing this is the first sign of a slowing market to come. The reality is, is that it will not be felt in force until 2017 if migration and job growth continue on this trend. Annually the Puget Sound seems strong – adding 39,682 jobs since May of 2015 and an estimated 86,000 new drivers to the region.”

The entire region saw a quarter over quarter increases of 7% in sales volumes, lead by Snohomish County at 18% followed by Pierce County at 7%. King County saw only a mild increase in sales volume of 1%. Skagit did increase significantly on a % basis but the total increase in sales was only 16 units. Kitsap has a lack of inventory and a small demand resulting in a 3% decrease.

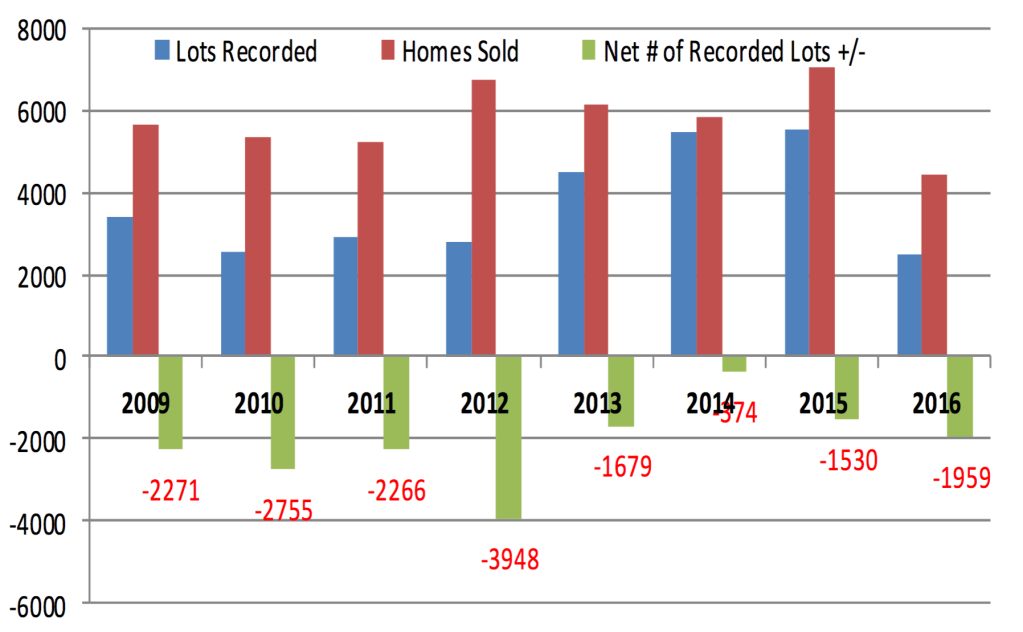

With fewer lots being delivered to the market than sales consistently since 2009 we have seen a net negative flow of lots totaling 16,782 lots. When looking forward at the number of lots preparing to come online this theme appears it is not going to change any time soon. As of the second quarter of 2016 the region has had 4,430 sales but only delivered 2,472 lots. It would not appear that the rest of 2016 is going to be any different with only 3,177 lots at final plat approval as of the end of Q2 and only an estimated 25% of them have the potential to be delivered in 2016. The vast majority of final platted lots in Pierce and Kitsap won’t be ready well into 2017.

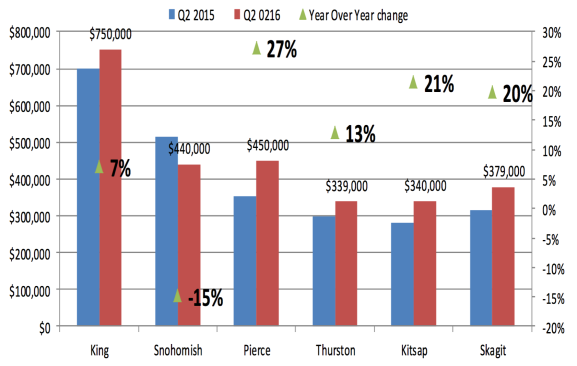

King County’s median list price is up 7% year over year currently at $750,000 and is currently at an all time high. The same can be said for Pierce County with a median available price of $450,000 as of June this year.

“We continue to see the “drive to qualify” impact,” said Britsch. “Builders and buyers are moving further out to more rural areas among all the counties in the central Puget Sound region which is then making it appear that price points have not risen nearly as much as they truly have. Pierce County’s list price jump of 19% in Q1 of 2016 was a little alarming being that the median household income is in the $53,000 range. But the Q2 16 over Q2 15 is even more so with an increase of 27% to $450k. While many buyers that cannot afford King County have chosen to migrate south to Pierce County. The demand has pushed prices upward to levels that are not sustainable. But, don’t expect relief any time soon with such a low supply of inventory in both king and Snohomish counties. King County’s total available inventory is just under a 15 month supply and Snohomish County is the lowest of any county in the Puget Sound region’s history at 10 months supply of recorded lots and homes.”

For further analysis of the Seattle market, reach out to regional director Todd Britsch: tbritsch@metrostudy.com