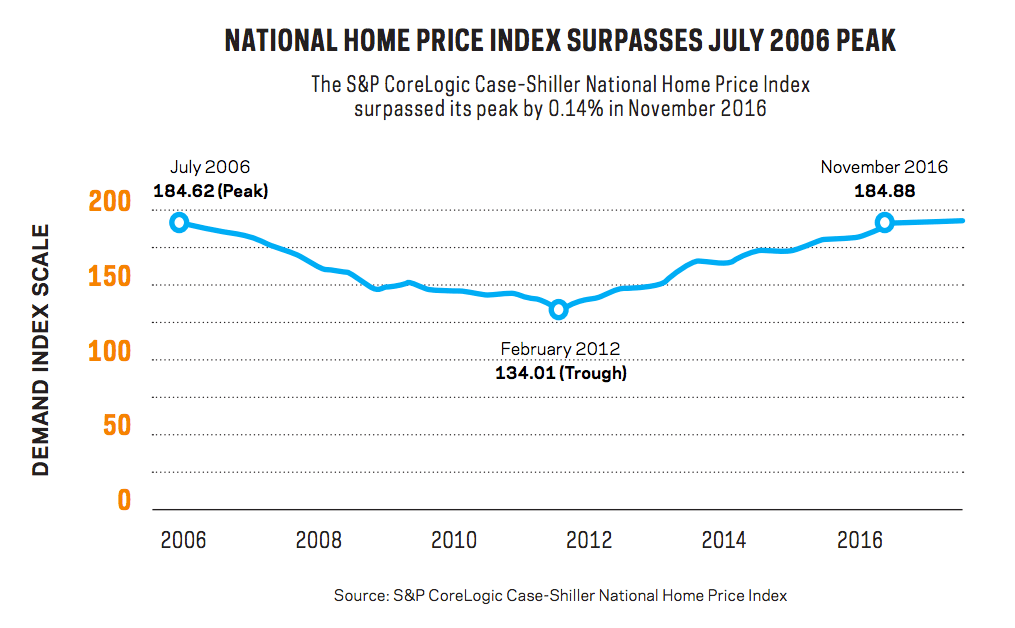

In January, home prices reached a 31-month high, according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index. More notably, the index surpassed its 2006 peak in November, after a year of significant increases. Low resale inventory in many major markets has driven buyers to the new-home market, but high prices continue to slow conversions or price out potential home buyers. Demand for new homes exists, and, according to our March Metrostudy-BUILDER Demand Index, it continues to grow. But low supply of new homes in affordable bands are keeping buyers away.

Our monthly gauge of buyer interest in 36 major markets has risen 10% since March 2016. The average score of 7.82 in March signals a strong spring selling season ahead, yet that might not apply to all markets. Builders in markets like the Twin Cities are still struggling to control costs as development and land costs rise, making the buyer and builder price issue an endless cycle. In Las Vegas, weekly sales center traffic is at an all-time high, yet conversions have decreased. Despite concerns about low inventory of entry-level product, the majority of regional directors are on the up-and-up about spring selling season.

In Dallas-Fort Worth, director Paige Shipp reports that the season is living up to its name, albeit in a different way. Competition in high-demand submarkets is weakening builders’ ability to push prices and requiring more incentives to close sales. Instead, builders are zoning in on “historically overlooked” submarkets, where they can deliver more affordably priced product.

Metrostudy directors report that the increase in interest rates hasn’t deterred potential buyers, which spotlights prices as the biggest factor preventing sales. The bigger concern is if the Federal Reserve decides on additional interest rate increases throughout the year-if both prices and interest rates become a deterrent for buyers, builders could have big problems closing sales.