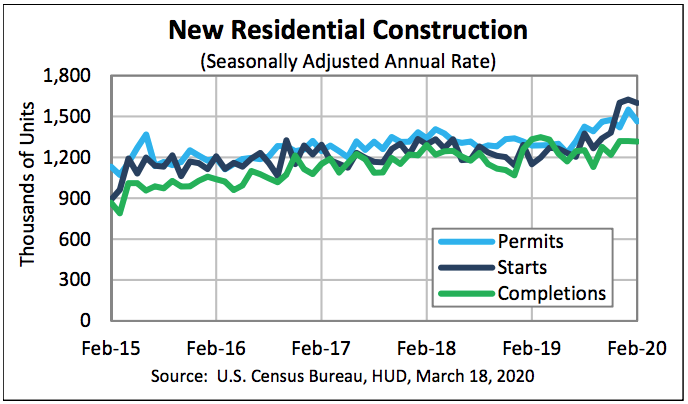

Housing starts in February came in at a seasonally adjusted annual rate of 1,599,000, a 1.5% decline from the revised January estimate of 1,624,000 but 39.2% above the February 2019 rate of 1,149,000, the Census Bureau and U.S. Department of Housing and Urban Development jointly announced Wednesday. The consensus expectation on Wall Street was for a rate of 1,493,000.

Single‐family housing starts in February were at a rate of 1,072,000, 6.7% above the revised January figure of 1,005,000 and a robust 35.4% increase from a year earlier. The February rate for units in buildings with five units or more was 508,000, down 17% from January.

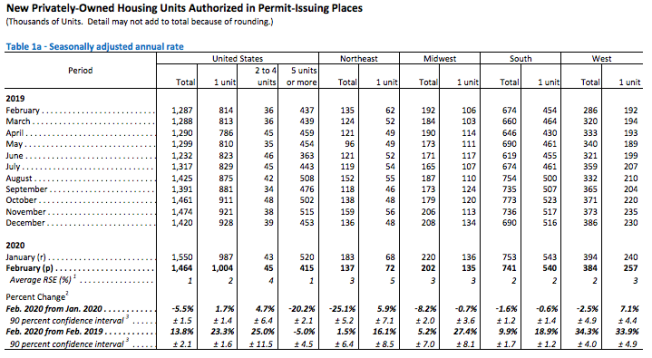

Building permits in February were at a seasonally adjusted annual rate of 1,464,000, 5.5% below the revised January rate of 1,550,000 but 13.8% above the February 2019 rate of 1,287,000. The rate fell short of expectations of a rate of 1,500,000.

Single‐family authorizations in February were at a rate of 1,004,000, 1.7% above the revised January figure of 987,000. Authorizations of units in buildings with five units or more were at a rate of 415,000 in February, down 20.2% from January and down 5% from a year earlier.

Housing completions in February were at a seasonally adjusted annual rate of 1,316,000, 0.2% below the revised January estimate of 1,319,000 and 1.2% below the February 2019 rate of 1,332,000.

Single‐family housing completions in February were at a rate of 1,027,000, 14.1% above the revised January rate of 900,000. The February rate for units in buildings with five units or more was 280,000.

Joel Kan, associate vice president of economic and industry forecasting for the Mortgage Bankers Association, analyzed the report: “Housing starts saw another strong month in February, another data point displaying the strength of the housing market before the impacts from the coronavirus. Despite a small decline of 1.5%, the overall pace of the starts remained in the 1.6 million unit range for the third straight month, close to the strongest annual pace since 2006. Single-family starts increased slightly and stayed over the 1 million unit pace, driven by increases in the South and Midwest. The 37% year-over-year increase in single-family starts was also notable, the largest since 2012.

He continued, “Single-family permits, which are typically an indicator of near term starts activity, remained strong as well. Multifamily starts decreased, but the January number was revised higher, and have similarly seen a strong three-month period. Permits for multifamily construction were lower in February and pulled back across most regions.

Kan concluded, “Due to the slowdown in economic growth and the volatility in markets from the coronavirus, mortgage rates will remain lower for longer, which will help home buyers in the longer run. However, we may start to see these home building trends take a turn for the worse, depending on the industry’s ability to continue day-to-day operations during these difficult times.”