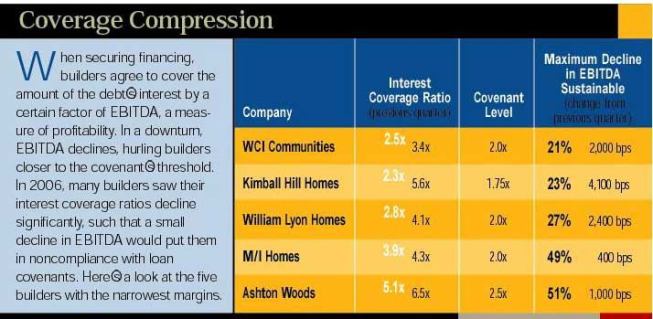

In an April special comment report, a follow-up to an original report in December, Moody’s Investors Service noted that several builders got their cash flow out of the red in the last quarter of 2006. However, more than half of the builders with public debt remain cash flow negative. More important, the amount of cash builders can afford to bleed before they can no longer cover the amount of their debt’s interest by a certain factor, as determined by the lender, is abating.

Moody’s vice president and senior credit officer Joseph Snider expects builders’ coverage cushions to continue to deflate, given slow sales and swollen inventories. By the end of 2007, he says many builders will have tripped their covenants, if they haven’t renegotiated their interest coverage terms.

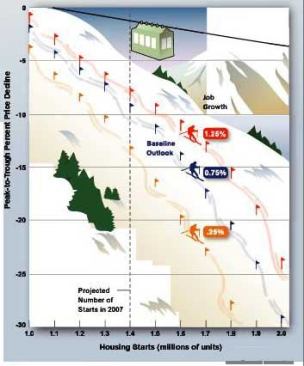

Add in the problems in the sub-prime mortgage market, and further deterioration in the housing market seems imminent. Sub-prime, Alt-A, interest-only, and adjustable-rate mortgage loans originated in 2005 and 2006, with a combined value of $1.5 trillion, are going to reset at substantially higher interest rates during 2007 and 2008, pushing more homeowners toward foreclosure. Snider estimates that foreclosures could put an additional 800,000 homes on the market, whereas tightening credit standards could result in 500,000 fewer home sales. Both would augment the inventory overhang problem, making it even more difficult for builders to burn through it fast enough to turn cash flow positive.

At the time of the April report, Moody’s had taken 15 negative ratings actions against builders since last summer. Snider confirms that “since the report was issued, we’ve taken a couple more [ratings] down.”

–Sarah Yaussi and William Gloede

New Rutenberg Designs

Three Arthur Rutenberg Homes franchise owners in Florida are unveiling four new home designs in communities in Melbourne, Naples, and St. Augustine. The designs, which range from 1,700 to 2,700 square feet, are smaller than a traditional Arthur Rutenberg home. However, by sacrificing space without surrendering some of the brand’s luxury appeal, the franchisees are able to diversify into new demographic segments by hitting lower price points.

Mark Refusco, a franchise owner based in Jacksonville, Fla., says the new products were a perfect fit for the 90-unit new-home community he’s got lined up in the St. Augustine market, Mission Trace.

“It’s helping me diversify to another price-point segment,” Refusco says of his decision to go with the new plans. “Not everyone has $1 million to spend or needs 3,500 square feet.”

Refusco expects that he’ll add two more home designs to the collection before the community’s built out, as he gathers feedback from buyers about the new plans.

Because the plans were developed as market plans, meaning generated for a specific geographic market, the plans have yet to work themselves into the Arthur Rutenberg portfolio nationally. However, Refusco expects these plans to pop up in different markets before too long. “We will start our models and specs in late June. And that’s when it’ll hit the Arthur Ruttenberg street,” he says.

–Sarah Yaussi

Learn more about markets featured in this article: Atlanta, GA, Kansas City, MO.