How should you think about the recent stock market moves? The stock market has moved in sympathy with oil prices, retail sales, China, and just plain “animal spirits.” Many are surprised at how suddenly and drastically it went jerking around, given that it was just moving forward like nothing was wrong when previous declines in oil prices occurred.

I heard a great analogy that puts it in perspective. Think of a dog owner walking a dog on a leash.

The owner is the economy. The dog is the stock market.

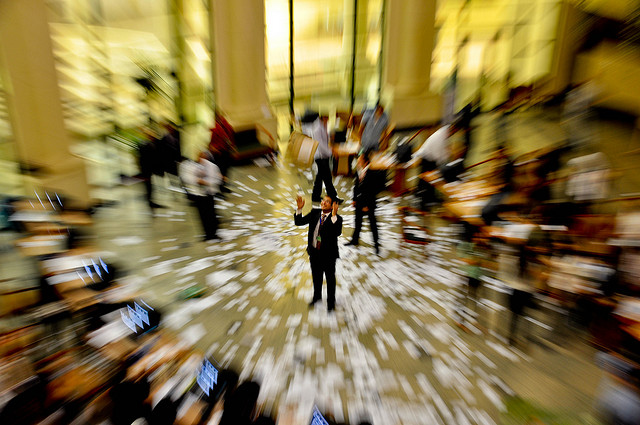

The dog’s owner is walking at a mostly steady pace, following a normal path, while the dog is zipping back and forth, sniffing, darting, and barking like a maniac at everything that moves. The dog gets away from the path frequently, but eventually always has to come back to the path.

This is apt, because the stock market went off barking and chasing, pulling forward until it was practically choking itself against the leash, and then it suddenly ran backward.

The Fed has been stimulating the economy for years now, with the aim of firing up investment and of adding a little bit of inflation. As a side-effect, it has caused the inflation of asset prices. Stocks.

Not only were stock prices propped up, but so were prices of famous works of art, houses, and land. Yes, “A” lot prices in many markets are back up to the same level (or higher than) the previous peak, partly/indirectly because of Fed policy. This is not to say that once the Fed reduces the stimulus that “A” lot prices will necessarily fall, but they should stop rising for a while.