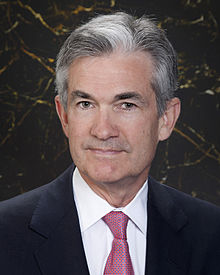

After months of speculation, President Donald Trump officially nominated Jerome Powell to be the next Federal Reserve chairman in a Rose Garden ceremony Thursday.

Powell, 64, a member of the Fed’s Board of Governors since 2012, will, if confirmed in the Senate, take over the post from Janet Yellen, whose terms expires in February.

Powell thanked Trump and said if he’s confirmed he will do everything in his power to achieve the goals assigned to the Federal Reserve by the Congress: stable prices and maximum employment.

In recent years, Powell said in a statement, the U.S. economy has made “substantial progress toward full recovery,” citing employment and inflation trends.

“Our financial system is without doubt far stronger and more resilient than it was before the crisis,” he said. “Our banks have much higher capital and liquidity, are more aware of the risks they run, and are better able to manage those risks. While post-crisis improvements in regulation and supervision have helped us to achieve these gains, I will continue to work with my colleagues to ensure that the Federal Reserve remains vigilant and prepared to respond to changes in markets and evolving risks.”

Powell served as an assistant secretary and as undersecretary of the Treasury under President George H.W. Bush, with responsibility for policy on financial institutions, the Treasury debt market, and related areas. Prior to joining the administration, he worked as a lawyer and investment banker in New York City.

Prior to his appointment to the Board, Powell was a visiting scholar at the Bipartisan Policy Center in Washington, D.C., where he focused on federal and state fiscal issues. From 1997 through 2005, he was a partner at The Carlyle Group.

Here’s how The New York Times describes his background:

Mr. Powell is a Republican with deep roots in the party’s establishment and in the financial industry, a lawyer by training and investment banker by trade. As chair, a position some consider as the second most powerful post in government, he will be the voice of an institution that is charged with keeping the economy on track by adjusting interest rates that influence the decisions of millions of Americans.

Powell praised Yellen and former Chairman Ben Bernanke for guiding “the economy with insight and courage through difficult times while moving monetary policy toward greater transparency and predictability.”

He added, “Inside the Federal Reserve, we understand that monetary policy decisions matter for American families and communities. I strongly share that sense of mission and am committed to making decisions with objectivity and based on the best available evidence, in the longstanding tradition of monetary policy independence.

Yellen, who was reportedly considered to remain on the job for another term, congratulated her colleague Thursday. “Jay’s long and distinguished career has been marked by dedicated public service and seriousness of purpose,” she said in a statement. “I am confident in his deep commitment to carrying out the vital public mission of the Federal Reserve. I am committed to working with him to ensure a smooth transition.”