So, will there be three 25 basis-point rate hikes by the Fed in 2017, or two?

Does a decline in pending home sales as tracked by the National Association of Realtors reflect a red-flag sensitivity–already clocking in–to post-election home mortgage rate spikes, or not?

“The budget of many prospective buyers last month was dealt an abrupt hit by the quick ascension of rates immediately after the election,” [NAR chief economist Lawrence] Yun said in NAR’s latest report. “Already faced with climbing home prices and minimal listings in the affordable price range, fewer home shoppers in most of the country were successfully able to sign a contract.”

Will prospective home buyers, now acclimated to a monthly-payment perspective on affordability and attainability of homeownership, suddenly feel priced out of the market by higher rates?

Will higher rates check the forward upward trajectory and momentum of house prices, both resale and new?

Will new inventory coming on line as home builders continue to open communities with a focus on entry-level and entry-level premium actually pull back on average selling price reins over the next year even as rates spiral upward?

Add your even better question about interest rates here.

All it took was a little window of time in the wee hours between Nov. 9 and Nov. 10 for a bunch of these questions to take on an entirely new complexion looking at the next few months to a couple of years. All it took was a Fed chief head-fake in May 2013, known as the “taper tantrum,” to set up this high-anxiety anticipation over what will happen to home builders’ painstakingly gained, molasses slow recovery if rates bounce to where affordability–the decoupling with household income trends with the monthly cash cocktail of principle, interest, taxes, insurance, and energy costs–becomes a real rather than relative issue again.

This is why team Zelman & Associates have devoted a deep-dive re-look at impacts and scenarios around reset expectations for interest rates following the Trump election victory in November, and allowing for “uncertainties” of the near term. The most recent–Dec. 16–issue of The Z Report notes:

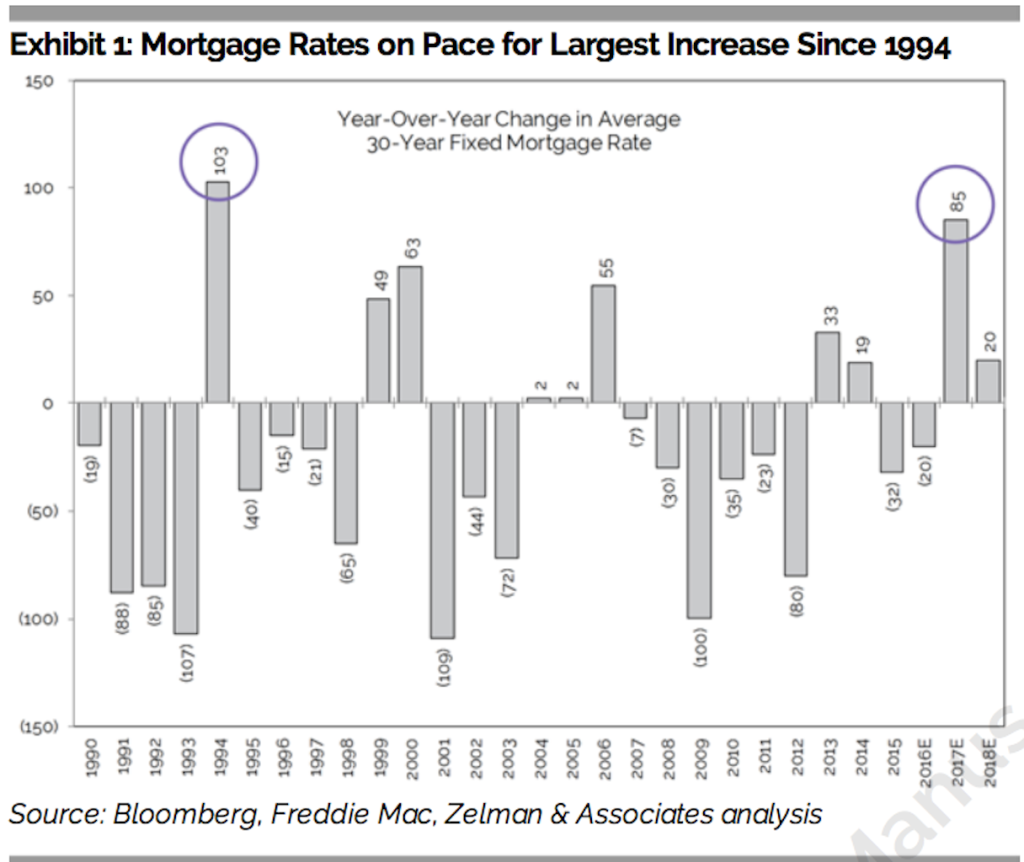

“So where are mortgage rates headed from here? According to reset expectations in the bond market, the 30-year fixed rate mortgage is on pace to reach 4.60% in 4Q17 and average 4.50% for all of 2017, assuming the spread with the 10-year Treasury remains approximately 165 basis points. While low in absolute terms, we note that this would represent an 85 basis point increase from 2016 and we believe that the relative change is important to potential homebuyers that shop on a monthly-payment basis. In fact, this would represent the largest annual increase in 23 years. (see image below).”

The Z Report offers unique analysis and insights of the housing market and related sectors. It is rooted in proprietary research and opinions and void of advertisements, focusing exclusively on rich content for executives and business leaders overlapping the apartment, building products, home building, home improvement, mortgage, real estate services, single-family rental and title insurance industries. Register here.