Hovnanian Enterprises, Red Bank, N.J. (NYSE:HOV) on Thursday reported a net loss of $337.2 million, or $2.28 per common share, in the third quarter of fiscal 2017 ended July 31. The loss included $294.0 million increase in the valuation allowance for deferred tax assets. The loss compared with a net loss of $0.5 million, or $0.00 per common share, during the same quarter a year earlier.

Shares of HOV were down more than 8% to $1.72 in late-day trading Thursday.

Among the results reported by the company:

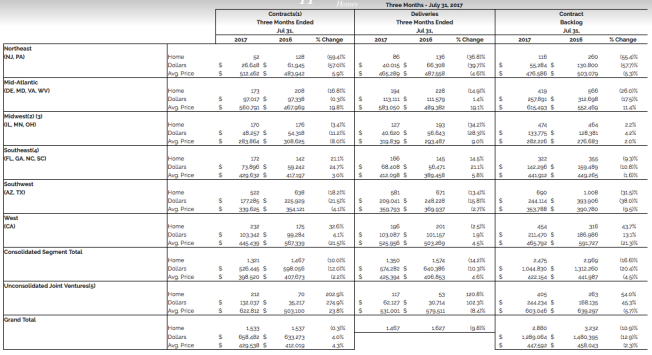

Primarily as a result of a 19.0% decline in community count and a conversion of 17 communities to joint ventures since the third quarter of fiscal 2016, total revenues decreased 17.4% to $592.0 million in the third quarter of fiscal 2017, compared with $716.9 million in the third quarter of fiscal 2016. For the nine months ended July 31, 2017, total revenues decreased 11.2% to $1.73 billion compared with $1.95 billion in the first nine months of the prior year.

Deliveries, including unconsolidated joint ventures, decreased 9.8% to 1,467 homes compared with 1,627 homes during the third quarter of fiscal 2016. Consolidated deliveries were 1,350 homes for the third quarter of fiscal 2017, a 14.2% decrease compared with 1,574 homes during the same quarter a year ago.

New contracts, including unconsolidated joint ventures, decreased 0.3% to 1,533 homes from 1,537 homes for the same quarter last year. The number of consolidated contracts, during the third quarter of fiscal 2017, decreased 10.0% to 1,321 homes compared with 1,467 homes during the third quarter of 2016.

As of the end of the third quarter of fiscal 2017, community count, including unconsolidated joint ventures, decreased 13.5% to 167 communities compared with 193 communities at July 31, 2016. Consolidated community count decreased 19.0% to 141 communities as of July 31, 2017 from 174 communities at the end of the prior year’s third quarter.

Consolidated contracts per community increased 11.9% to 9.4 contracts per community for the third quarter of fiscal 2017 compared with 8.4 contracts per community in the third quarter of fiscal 2016. Contracts per community, including unconsolidated joint ventures, increased 15.0% to 9.2 contracts per community for the quarter ended July 31, 2017 compared with 8.0 contracts, including unconsolidated joint ventures, per community in last year’s third quarter.

The dollar value of contract backlog, including unconsolidated joint ventures, as of July 31, 2017, was $1.29 billion, a decrease of 12.9% compared with $1.48 billion as of July 31, 2016. The dollar value of consolidated contract backlog, as of July 31, 2017, decreased 20.4% to $1.04 billion compared with $1.31 billion as of July 31, 2016.

The consolidated contract cancellation rate for the three months ended July 31, 2017 decreased to 19%, compared with 21% in the third quarter of the prior year. The contract cancellation rate, including unconsolidated joint ventures, was 20% in the third quarter of fiscal 2017 compared with 22% in the third quarter of fiscal 2016.

For the third quarter of 2017, total SG&A decreased by $5.4 million, or 8.0%, year over year. Total SG&A was $61.2 million, or 10.3% of total revenues, for the third quarter ended July 31, 2017 compared with $66.6 million, or 9.3% of total revenues, in last year’s third quarter.

Home building gross margin percentage, after interest expense and land charges included in cost of sales, was 12.8% for the third quarter of fiscal 2017 compared with 13.1% in the prior year’s third quarter. During the first nine months of fiscal 2017, this home building gross margin percentage was 12.9% compared with 11.9% in the same period of the previous year.

Total liquidity at the end of the third quarter of fiscal 2017 was $288.2 million.

During the third quarter of fiscal 2017, land and land development spending was $149.8 million compared with $132.3 million in last year’s third quarter and up from the 2017 second quarter’s spend of $99.7 million. For the nine months ended July 31, 2017, land and land development spending was $439.9 million compared with $435.6 million for the same period one year ago.

The total land position, including unconsolidated joint ventures, was 31,143 lots, consisting of 14,467 lots under option and 16,676 owned lots, as of July 31, 2017, compared with a total of 32,125 lots as of July 31, 2016.

In the third quarter of fiscal 2017, approximately 2,700 lots were put under option or acquired in 34 communities, including unconsolidated joint ventures.

“We continued to see strength in the underlying housing market and the 11.9% increase in our contracts per community during the third quarter of 2017 compared to last year’s third quarter reflected this trend,” stated Ara K. Hovnanian, chairman, president and CEO. “While deliveries and revenues were lower than last year as a result of a decreased community count, the strong sales and our backlog as of July 31, 2017 should lead to a profitable fourth quarter.”

“Near the end of the third quarter, we successfully refinanced and extended the maturities of our secured debt that was scheduled to come due in the fall of 2018 and 2020 with $440 million of secured debt with maturities in July 2022 and $400 million of secured debt with maturities in July 2024. The refinancing, which has tremendous long term benefits, resulted in a $42 million loss on early extinguishment of debt. When added to prior period results, this created a three-year cumulative loss, which led to a $294 million non-cash increase in the valuation allowance for our deferred tax assets. Our third-quarter operating results were consistent with our prior guidance.”

“Fortunately, less than ten homes within two of our 45 Houston communities experienced flood damage from Hurricane Harvey. The storm damage and construction delays caused by the storm will reduce our fourth quarter deliveries. In spite of the temporary impact from Hurricane Harvey, the long-term prospects for the Houston market remain strong.”

He concluded, “As we move forward with the benefit of longer term financing, we remain focused on reloading our land position and returning to consistent profitability. While this has been a long and arduous recovery, we are confident that we can successfully deploy our strategies and remain on track for long term success in the future.”