An important economic story for 2017 will be a rising rate of inflation. In historical terms, inflation will remain low. However, NAHB forecasts that inflation in 2017 and 2018 will exceed 2% for each year, marking the highest pace of price increases since 2012.

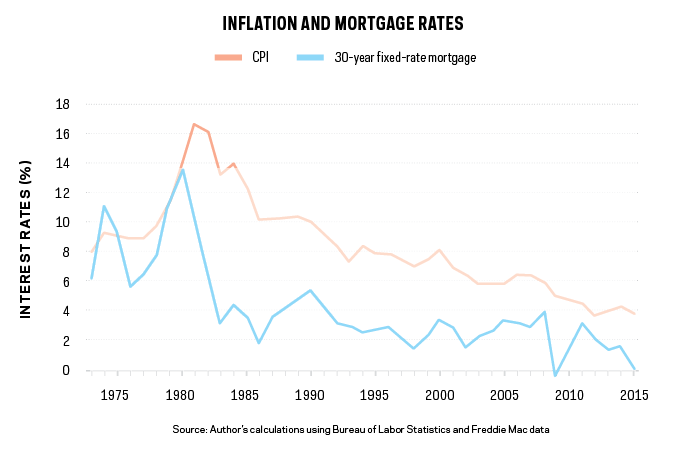

What impacts will additional inflation have on builders? First, mortgage interest rates are expected to rise. NAHB is forecasting the average 30-year fixed-rate mortgage to increase to just below 5% by the end of 2018—still historically low, but higher than with which this generation’s home buyers are familiar. The primary challenge to most home buyers is accumulating savings for a down payment and qualifying for a mortgage, but rising rates do reduce budgets.

Second, input costs, such as land and labor costs, will go up. Given ongoing scarcity of both factors in the building industry, inflation will place additional upward pressure on prices. Inflationary pressure could also raise the interest rate required for acquisition, development, and construction loans in an environment in which lending conditions for commercial real estate loans are tightening.

Why is inflation accelerating? The primary reason in the current cycle is short-term factors related to economic capacity. For example, the unemployment rate has been below 5.5% since May 2015. As the economy creates jobs, the pool of available workers becomes tighter and enterprises must offer higher wages to recruit.

This raises an important concern as the Trump administration assumes office. A key proposal from Trump’s campaign involved a trillion-dollar plan for infrastructure investment. Such a plan would offer positives for the economy. However, given the low unemployment rate and ongoing worker shortage, this fiscal policy—particularly if deficit-financed—would increase inflation and force the Federal Reserve to accelerate its planned interest rate hikes.

As such, it’s important for the government to consider policies that would hold back inflation. First, enact labor rules (including tax policies) that reward work. The labor force participation rate declined from 66.2% to 62.8% over the past 10 years. This reduction in the number of available workers cannot all be explained by the aging of America. Reducing taxes on workers or lowering the cost of hiring for employers would help stop the decline in number of people in the labor force and help hold back wage-related inflation.

Building more housing also can help as higher housing costs, for rental and owner-occupied, contribute to inflation. Smart regulatory policy that encourages construction can be a policy tool to check inflationary pressures.