The government release on housing starts for June showed a sharp decline, concentrated in what the Census Bureau defines as “The South.” Single-family starts were down in June by 9.0% from the previous month, and down 4.3% from twelve months earlier. Within that number, almost all the decline was in the South, down 20.1% versus the previous month and down 14.5% versus a year ago.

Rumors of the South’s demise are greatly exaggerated.

For one thing, when you look at the Census data on a quarterly basis, the decline versus the prior quarter was only 5%. Comparing versus four quarters ago, starts were essentially unchanged.

It is also important to understand that the government’s numbers are based on a small sample, and therefore carry a huge error factor. The Census release says that starts in the South fell 14.5%, plus or minus 13.8%. This “confidence interval” says that Census is 90% confident that the change was somewhere between 0.7% and 28.3%. Such a range is not very informative, and the likelihood of a revision is high.

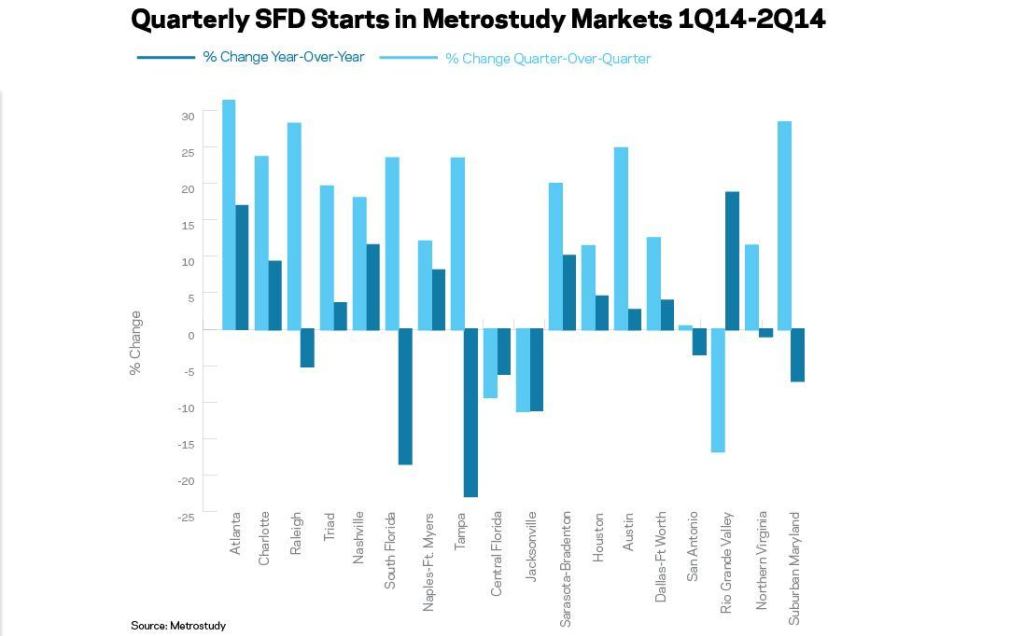

Metrostudy’s numbers, based upon a 100% count (meaning no “confidence interval”) show that the South is still (with a few exceptions) growing! Quarter-on-quarter, only three markets in the South saw declines. Year-on-year, seven out of 18 did. The decline in Raleigh versus a year ago does reflect a slowdown in lot development during the icy winter, but much of the South has still seen rising starts.