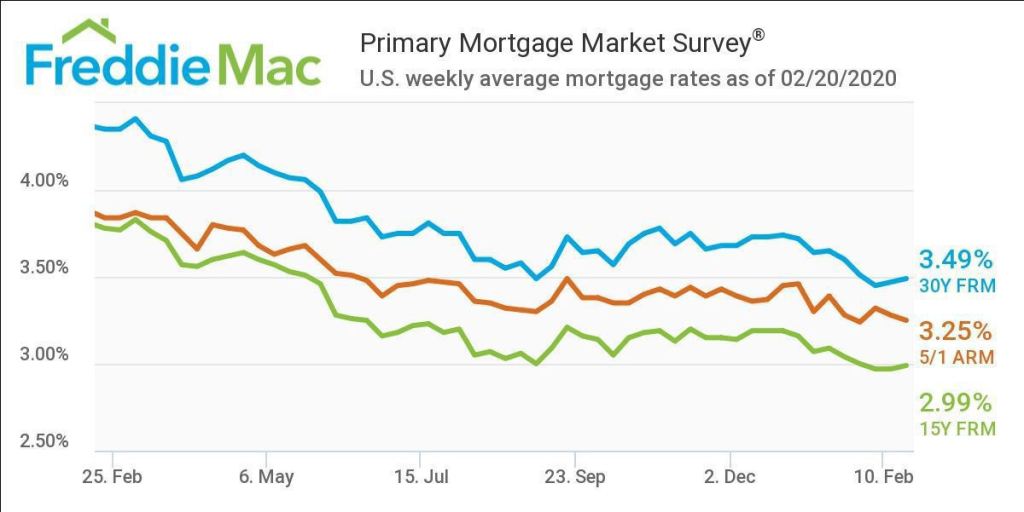

Freddie Mac today released the results of its Primary Mortgage Market Survey, showing that the 30-year fixed-rate mortgage averaged 3.49%. “The low mortgage rate environment continues to spur homebuying activity, with applications to purchase a home up 15% from a year ago,” said Sam Khater, Freddie Mac’s chief economist. “We’ve seen new residential construction surge over the last few months, on pace to reach the highest level in more than a decade. This is a good sign for the inventory-starved housing market and is a promising indication for the spring homebuying season.”

News Facts

- 30-year fixed-rate mortgage averaged 3.49% with an average 0.7 point for the week ending February 20, 2020, slightly up from last week when it averaged 3.47%. A year ago at this time, the 30-year FRM averaged 4.35%.

- 15-year fixed-rate mortgage averaged 2.99% with an average 0.8 point, slightly up from last week when it averaged 2.97. A year ago at this time, the 15-year FRM averaged 3.78%.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.25% with an average 0.2 point, down from last week when it averaged 3.28%. A year ago at this time, the 5-year ARM averaged 3.84%.