Mortgage denials, which peaked at the onset of the housing crash, have fallen back to a 20-year low, Zillow reported Thursday.

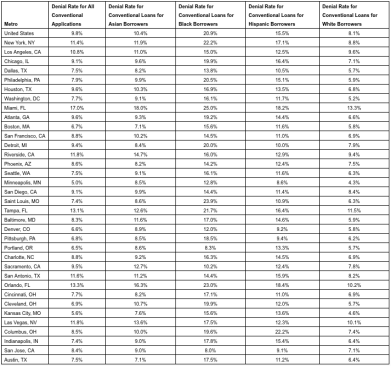

Nationally, the share of applicants who are denied for conventional mortgages has fallen to 9.8%, according to data from the Home Mortgage Disclosure Act (HMDA), down from 18.1% in 2007.

Zillow noted that even though a smaller share of loan applicants overall are denied, white or Asian borrowers are more likely to be approved for a mortgage than black or Hispanic borrowers. In 2016, 8.1% of white applicants were denied for a conventional loan, as were 10.4% of Asian applicants. By comparison, 20.9% of black borrowers and 15.5% of Hispanic borrowers were turned down for a loan.

Income and credit rating data were not taken into account in the Zillow analysis.

For all groups, denial rates are down sharply from 2007. In 2007, 34.3% of black applicants and 30% of Hispanic applicants were denied for mortgages. White and Asian borrowers were denied 12.7% and 16.2% of the time, respectively.

The persistent disparity among races also is evident in home ownership. The gap between black and white home-ownership rates was slightly wider in 2016 than it was in 1900. Black home buyers had the least purchasing power last year – they could afford 55% of homes for sale, while white home buyers could buy about 78% of listed homes. And while coming up with a down payment is the biggest hurdle to home ownership for all potential buyers, black Americans were more likely than those of other races to say qualifying for a mortgage was a barrier.

“Mortgage approval data point to both progress and stubborn inequities in the American housing market,” said Zillow® Senior Economist Aaron Terrazas. “By some measures, the gap in mortgage approval rates between whites and blacks is as narrow as it has ever been. However, black mortgage applicants are still more than twice as likely as whites to be denied, a visible legacy of historical discriminatory policies. For the large majority of home buyers, getting approved for a loan is the first step on the road to home ownership, and these continued disparities represent an ongoing barrier to housing and social equity in America.”

For all racial and ethnic groups, borrowers in suburban areas had the best chances of being approved for a mortgage – 8.4% of suburban home buyers were denied for a loan, while 10% of urban borrowers and 11.5% of rural borrowers were turned down.