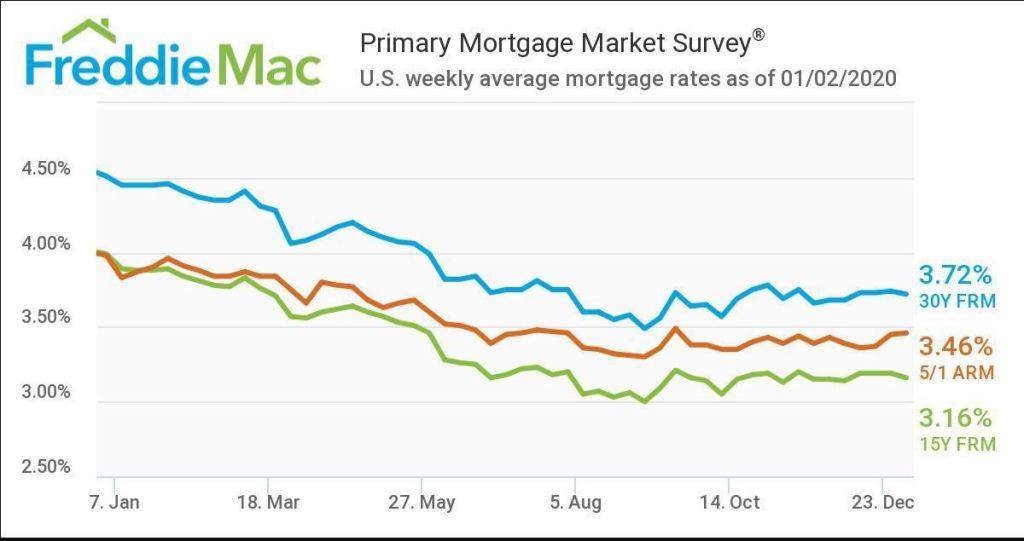

Freddie Mac today released the results of its Primary Mortgage Market Survey, showing that the 30-year fixed-rate mortgage averaged 3.72%.

“The combination of improved economic data and market sentiment has led to stability in mortgage rates, which have hovered around 3.7% for nearly the last two months,” said Sam Khater, Freddie Mac’s chief economist. “The stability is welcome news after the interest rate turbulence of the last year, which caused a slowdown in the housing market and other interest rate sensitive sectors. The low mortgage rate environment combined with the red-hot labor market is setting the stage for a continued rise in home sales and home prices.”

News Facts

- 30-year fixed-rate mortgage averaged 3.72% with an average 0.7 point for the week ending January 2, 2020, slightly down from last week when it averaged 3.74%. A year ago at this time, the 30-year FRM averaged 4.51%.

- 15-year fixed-rate mortgage averaged 3.16% with an average 0.7 point, down from last week when it averaged 3.19%. A year ago at this time, the 15-year FRM averaged 3.99%.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.46% with an average 0.3 point, slightly up from last week when it averaged 3.45%. A year ago at this time, the 5-year ARM averaged 3.98%.