The New Home Company (NYSE: NWHM), Aliso Viejo, California, late Thursday reported a net loss of $3.0 million, or -$0.15 per diluted share, including $10.1 million of pretax inventory and joint venture impairment charges. Wall Street was expecting a gain of $0.11 per share, but the loss compared favorably to a loss of $16.1 million, or -$0.80 per share, in the comparable 2018 quarter.

Total revenues for the 2019 fourth quarter were $222.1 million, compared to $229.7 million in the prior year period. The 2019 fourth quarter results included a net tax benefit of $1.2 million related to federal energy tax credits that were extended during the quarter for homes delivered during 2018 and 2019. Adjusted net income for the 2019 fourth quarter was $3.1 million, or $0.15 per diluted share, after excluding a $6.6 million pretax inventory impairment charge and a $3.5 million pretax joint venture impairment charge. Adjusted net income for the 2018 fourth quarter was $5.6 million, or $0.28 per diluted share, and excluded $10.0 million in pretax inventory impairment charges and a $20.0 million pretax joint venture impairment charge.

Wholly Owned Projects

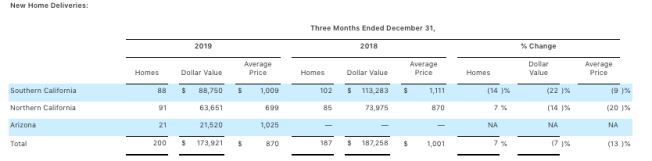

Home sales revenue for the 2019 fourth quarter was down 7% from the 2018 fourth quarter at $173.9 million compared to $187.3 million in the year ago period. The decrease in home sales revenue was driven by a 13% decline in average selling price to $870,000 from $1.0 million for the 2018 fourth quarter, which was partially offset by a 7% increase in home deliveries. The lower year-over-year average selling price was impacted by mix, particularly in Northern California where 2019 fourth quarter average home price was down 20% due to a shift from higher-priced Bay Area communities to more affordable communities within the Sacramento region, which was partially offset by the addition of Arizona deliveries where the average selling price exceeded $1.0 million.

Gross margin from home sales for the 2019 fourth quarter was 7.8% and included $6.6 million in inventory impairment charges related to one luxury condominium community in Scottsdale, AZ. Home sales gross margin for the 2018 fourth quarter was 8.1% and included $10.0 million in inventory impairment charges related to two higher-priced communities in Southern California. Excluding home sales impairments, our home sales gross margin was 11.6% for the 2019 fourth quarter as compared to 13.5% for the prior year period. The 190 basis point decline was primarily due to increased incentives and higher interest costs. Adjusted home building gross margin, which excludes home sales impairment charges and interest in cost of home sales, was 16.8% for the 2019 fourth quarter versus 17.7% in the prior year period.

The company’s SG&A expense ratio as a percentage of home sales revenue for the 2019 fourth quarter was flat with the 2018 fourth quarter at 9.9% despite a 7% decrease in home sales revenue. SG&A expenses were down year-over-year due to reduced personnel expenses, more efficient marketing and advertising spend, and lower co-broker commissions as compared to the prior year period. These decreases were partially offset by a $0.7 million reduction in the amount of G&A expenses allocated to fee building cost of sales in the 2019 fourth quarter due to lower fee building activity and joint venture management fees.

Net new home orders for the 2019 fourth quarter increased 106% primarily due to improved monthly sales absorption rates, and to a lesser extent, a slight increase in average selling communities. The monthly sales absorption rate for the Company was up 83% to 2.2 for the 2019 fourth quarter compared to 1.2 for the prior year period. We ended the 2019 fourth quarter with 21 active communities, up from 20 at the end of the 2018 fourth quarter.

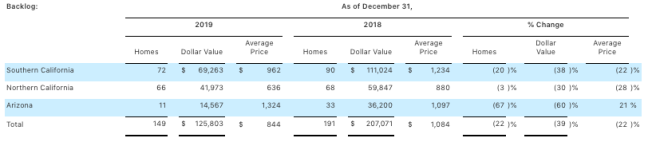

The dollar value of the company’s wholly owned backlog at the end of the 2019 fourth quarter was $125.8 million and totaled 149 homes compared to $207.1 million and 191 homes for the prior year period. The decrease in backlog units was driven primarily by a lower beginning backlog coupled with a higher backlog conversion rate for the 2019 fourth quarter, partially offset by a 106% increase in net new orders. Our backlog conversion rate was 97% for the 2019 fourth quarter as compared to 61% in the year ago period. The increase in the 2019 conversion rate resulted from the company’s move to more affordably priced product, which generally has quicker build cycles, as well as the company’s success in selling and delivering a higher number of spec homes. The decline in backlog dollar value was due to fewer units in ending backlog as well as a 22% decrease in average selling price as the Company continues its transition to more affordable product.

Land Sales

During the 2019 fourth quarter, the company sold a land parcel in Northern California and recorded land sales revenue of $17.1 million compared to no land sales revenue for the 2018 fourth quarter.

Fee Building Projects

Fee building revenue for the 2019 fourth quarter was $31.1 million, compared to $42.4 million in the prior year period. The decrease in fee building revenue was largely due to less construction activity in Irvine, California. Additionally, management fees from joint ventures and construction management fees from third parties, which are included in fee building revenue, decreased to $0.5 million for the 2019 fourth quarter as compared to $1.6 million for the 2018 fourth quarter. The lower fee building revenue and decrease in management fees, offset partially by a reduction in allocated G&A expenses, resulted in a fee building gross margin of $0.5 million for the 2019 fourth quarter versus $1.1 million in the prior year period.

Unconsolidated Joint Ventures (JVs)

The company’s share of joint venture loss for the 2019 fourth quarter was $3.8 million as compared to a $19.9 million loss for the prior year period. Included in the company’s allocated losses were $3.5 million and $20.0 million in impairment charges for the 2019 fourth quarter and 2018 fourth quarter, respectively. The 2019 impairment related to an investment in a land development joint venture in Southern California, and the 2018 impairment related to an investment in a land development joint venture in Northern California.

Full Year 2019 Operating Results

Total revenues for the year ended December 31, 2019 were $669.3 million compared to $667.6 million for the prior year. Home building revenue increased to $532.4 million primarily from a 15% increase in deliveries, partially offset by an 8% decrease in the average selling price of homes as the strategic shift to more affordably priced homes continued throughout 2019.

For the full year 2019, the company reported a net loss of $8.0 million, or $(0.40) per diluted share. Adjusted net income for the year was $3.3 million, or $0.16 per diluted share, after excluding $10.2 million in pretax inventory impairment charges, a $3.5 million pretax joint venture impairment charge, and $1.5 million in land sales losses. The company’s net loss for 2018 was $14.2 million, or $(0.69) per diluted share. Adjusted net income for 2018 was $7.6 million, or $0.37 per diluted share, and excluded $10.0 million in pretax inventory impairment charges and a $20.0 million pretax joint venture impairment charge. The year-over-year decrease in net loss was primarily attributable to a $16.5 million decrease in joint venture impairment charges, a 6% increase in home sales revenue, and a 60 basis point improvement in SG&A expenses as percentage of home sales revenue. These increases were partially offset by a 120 basis point decline in home sales gross margin (160 basis point decline before impairments*), a 42% decrease in fee building revenue, and a reduction in income tax benefit.

Balance Sheet and Liquidity

The company generated $62.7 million in operating cash flows during the 2019 fourth quarter and ended the quarter with $79.3 million in cash and cash equivalents, and $304.8 million in debt. At December 31, 2019, the company had a debt-to-capital ratio of 56.7% and a net debt-to-capital ratio of 49.2%. As of December 31, 2019, the company owned or controlled 2,701 lots through its wholly owned operations (excluding fee building and joint venture lots), of which 1,123 lots, or 42%, were controlled through option contracts.

Guidance

The company’s current estimate for the 2020 first quarter is as follows:

- Home sales revenue of $75 – $90 million

- Fee building revenue of $20 – $30 million

- Home sales gross margin of 11.8% – 12.1%

“2019 was a pivotal year for our company as we committed early in the year to generating cash flow, deleveraging our balance sheet, and improving SG&A efficiency to address a weaker housing market to start the year,” remarked Larry Webb, executive chairman of The New Home Company. “By the end of 2019, we had generated $121 million in operating cash flow, reduced our net debt by approximately $83 million, and established a more streamlined cost structure which included right-sizing our operations by reducing headcount, along with improved selling, marketing and administrative expense leverage. At the end of 2019, our net debt-to-capital ratio was 49.2%, a 980 basis point year-over-year improvement.”

Leonard Miller, president and CEO stated, “Buyer demand steadily improved throughout the year with our monthly net new orders up for the final five months of 2019. The 2019 fourth quarter was particularly strong with our monthly sales pace up 83% resulting in a 106% increase in net new orders over the prior year period. Demand was strongest at our more affordable, entry level communities where monthly absorption increased to 3.3 for the 2019 fourth quarter, further underscoring the benefit of our ongoing strategy to diversify our product portfolio and expand our customer base. Additionally, our backlog conversion rate improved to 97% for the 2019 fourth quarter from 61% for the 2018 fourth quarter as we continued to capitalize on the shorter build cycles and quicker conversion of spec homes that our more affordable product provided resulting in higher inventory turns and a 7% increase in new home deliveries for the 2019 fourth quarter.”

Miller concluded, “The improvements we made during 2019 to our financial leverage ratios, our product diversification and our cost structure, coupled with a favorable fundamental backdrop for our industry, give us optimism for our Company’s prospects as we enter the new year.”