The New Home Company Inc. (NYSE: NWHM), Aliso Viejo, California, on Friday reported a net loss for the 2020 first quarter of $8.5 million, or ($0.42) per diluted share, compared to a net loss of $2.0 million, or ($0.10) per diluted share, in the prior year period. Analysts were expecting a loss of ($0.10) per share.

Total revenues for the 2020 first quarter were $132.0 million as compared to $118.8 million in the prior year period. During the quarter, the company realized an $18.4 million pretax loss as compared to a pretax loss of $2.7 million in the prior year period. The 2020 first quarter included a $14.0 million non-cash project abandonment charge and a $2.3 million impairment charge related to the anticipated sale of its membership interest in a land development joint venture in Southern California that is expected to be finalized during the second quarter.

Home sales revenue for the 2020 first quarter decreased 4% to $95.7 million compared to $99.2 million in the prior year period. The decrease in home sales revenue was driven largely by an 11% decrease in average selling price to $894,000 from $1,002,000 a year ago, and was partially offset by an 8% increase in deliveries. The lower year-over-year average selling price was impacted by mix, with Southern California delivering a higher mix of more affordable and first move-up homes during the 2020 first quarter compared to the prior year and fewer deliveries from our higher-priced Icon community in Scottsdale, Arizona.

Gross margin from home sales for the 2020 first quarter was 11.4% compared to 12.7% for the prior year period. The 130 basis point decrease was primarily due to higher interest costs and, to a lesser extent, higher incentives, which were partially offset by a product mix shift. Adjusted home building gross margin, which excludes interest in cost of home sales, was 17.9% for the 2020 first quarter as compared to 17.6% in the prior year period.

The company’s SG&A expense ratio as a percentage of home sales revenue for the 2020 first quarter was 14.1% compared to 16.2% in the prior year period. The 210 basis point improvement in the SG&A rate was primarily due to $1.8 million of severance charges included in the 2019 first quarter as well as lower amortization of capitalized selling and marketing costs. Excluding 2019 first quarter severance charges, the SG&A rate improved 30 basis points to 14.1% as compared to 14.4%* in the prior year period. The year-over-year decrease in the SG&A rate was partially offset by a $0.5 million reduction in G&A expenses allocated to fee building cost of sales for the 2020 first quarter as compared to the prior year period.

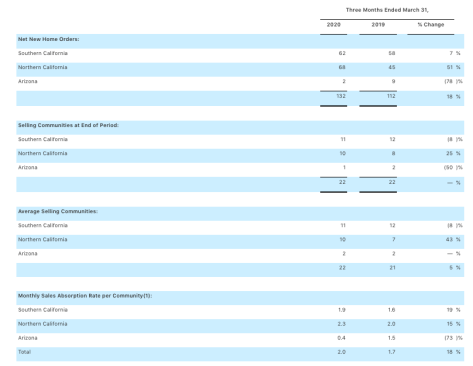

Net new home orders for the 2020 first quarter increased 18% primarily due to improved monthly sales absorption rates during the first two months of the quarter, and to a lesser extent, a slight increase in average selling communities. The monthly sales absorption rate was also up 18% to 2.0 for the 2020 first quarter as compared to 1.7 for the prior year period. Absorption rates were solid during the first two months of the 2020 first quarter, but were adversely impacted by the COVID-19 pandemic in the second half of March, where our monthly net orders decreased 28% for the month of March as compared to the prior year. We ended the 2020 first quarter with 22 active selling communities, flat with the prior year.

The dollar value of the Company’s wholly owned backlog at the end of the 2020 first quarter was $130.2 million and totaled 174 homes as compared to $212.6 million and 204 homes for the prior year period. The decrease in backlog units and dollar value was driven largely by a lower beginning backlog and a higher backlog conversion rate for the 2020 first quarter. The backlog conversion rate was 72% for the 2020 first quarter as compared to 52% in the year ago period. The higher conversion rate in 2020 resulted primarily from the company’s shift to more affordably priced product, which generally has quicker build cycles and shorter backlog periods. The decline in backlog dollar value was also impacted by a 28% decrease in average selling price as the company continues its transition to more affordable product.

Fee building revenue for the 2020 first quarter was $36.2 million, compared to $19.7 million in the prior year period. The increase in fee revenues was largely due to increased construction activity in Irvine, California. Additionally, management fees from joint ventures and construction management fees from third parties, which are included in fee building revenue, decreased to $0.5 million for the 2020 first quarter as compared to $1.3 million for the 2019 first quarter. The higher fee building revenue and a reduction in allocated G&A expenses, offset partially by the decrease in management fees, resulted in a fee building gross margin of $0.7 million for the 2020 first quarter compared to $0.4 million in the prior year period.

The company’s joint venture loss for the 2020 first quarter was $1.9 million as compared to $0.2 million in income for the prior year period. Included in the company’s allocated losses for the 2020 first quarter was a $2.3 million impairment recorded in connection with an agreement in principle to sell its membership interest in a land development joint venture in Southern California to its partner that is expected to close around the end of the 2020 second quarter.

The company expensed $718,000 of interest costs directly to interest expense during the 2020 first quarter in accordance with Accounting Standards Codification 835, as its qualified assets were less than its qualified debt.

During the 2020 first quarter, the company terminated its option agreement for a luxury condominium project in Scottsdale, Arizona due to lower demand levels experienced at this community, substantial investment required to build out the remainder of the project and the opportunity to recognize a tax benefit from net operating loss carrybacks. As a result of this strategic decision to forgo developing the balance of the property, we recorded a noncash project abandonment charge of $14.0 million related to the capitalized costs associated with the portion of the project that was abandoned.

The company recorded an income tax benefit of $9.9 million for the 2020 first quarter as compared to $0.7 million in the prior year period. The 2020 first quarter included discrete items totaling an $8.1 million benefit, $5.8 million of which related to the $14.0 million noncash project abandonment charge recorded during the quarter, and a $2.1 million benefit related to the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) that allows companies to carry back net operating losses generated in 2018 through 2020 for five years. The remeasurement of deferred tax assets originally valued at a 21% federal statutory tax rate are now available to be carried back to tax years with a 35% federal statutory rate.

The company generated $17.3 million in operating cash flows during the 2020 first quarter and ended the quarter with $87.9 million in cash and cash equivalents. The company had no borrowings outstanding under its revolving credit facility as of March 31, 2020 and had $300.5 million in net debt outstanding related to its senior notes which mature on April 1, 2022. At March 31, 2020, the company had a debt-to-capital ratio of 57.5% and a net debt-to-capital ratio of 48.8%*. As of March 31, 2020, the company owned or controlled 2,463 lots through its wholly owned operations (excluding fee building and joint venture lots), of which 1,053 lots, or 43% were controlled through option contracts.

During the 2020 first quarter, the company repurchased and retired 1,233,883 shares of common stock through open market purchases, a privately negotiated transaction, and a 10b5-1 plan for $2.2 million, or $1.80 per share. Subsequent to quarter end through May 7th, the company repurchased an additional 777,300 shares through its 10b5-1 plan for $1.4 million, which when combined with first quarter repurchases represented a total of 2,011,183 shares for $3.6 million, or approximately 10% of our outstanding shares since the beginning of the year. The repurchases were made under a previously announced stock repurchase program that had a remaining purchase authorization of $1.8 million as of May 7, 2020.

Separately, the company has adopted a tax benefit preservation plan to help preserve the value of its net operating losses and other tax attributes. As of March 31, 2020, the company had approximately $85.7 million of gross deferred tax assets, which are valued on a tax-effected basis at approximately $16.6 million. The plan was adopted to protect tax benefits that can include the offset of tax liability arising from future taxable earnings or gains. The value of these tax benefits would be substantially limited if the company were to experience an “ownership change” as defined under Section 382 of the Internal Revenue Code. In general, an ownership change would occur if stockholders that own (or are deemed to own) at least 5% or more of the outstanding common stock of the company increased their cumulative ownership in the company by more than 50 percentage points over their lowest ownership percentage within a rolling three-year look-back period starting January 1, 2018.

“These are unprecedented times for our nation and our industry,” said Larry Webb, executive chairman of The New Home Company. “While we are finding ways to continue our operations in the midst of this pandemic, our first order of business remains the health and safety of our employees, trade partners and home buyers. We have been vigilant in our response to the virus’ outbreak and have implemented policies and practices that adhere to the guidelines issued by the CDC and government and public health agencies to combat its spread. Although the road ahead is uncertain, I remain confident in the resiliency of our industry and the talented people of our organization to adjust to this new reality.”

Leonard Miller, president and CEO, stated, “While The New Home Company experienced a successful start to the year, demand trends softened during March as we began to experience the negative impact stemming from the COVID-19 pandemic. Year-over-year orders for January and February increased 32% and 82%, respectively, before declining 28% in March. This order softness carried into April, as shelter-in-place mandates and concerns over the virus weighed on our sales efforts. Fortunately, due in part to home building being recognized as an “essential business” in most of the markets in which we operate, we were able to deliver a number of homes in backlog during the quarter, allowing us to exceed our stated home sales revenue guidance and generate $17.3 million in operating cash flow.”

Miller continued, “We ended the quarter with approximately $88 million in cash and cash equivalents, no borrowings outstanding on our bank credit facility and a net debt-to-total capital ratio of 48.8%. We have taken steps to preserve capital by implementing additional cost cutting measures, curtailing the acquisition and development of land, and renegotiating lot takedown arrangements. We have also made the strategic decision to walk away from some projects altogether, which resulted in one-time charges of approximately $16.3 million during the quarter, but will unburden us from substantial future capital outlays and should provide us with tax refunds resulting from NOL carrybacks. We believe these actions are in the company’s best interest in light of current market conditions and recent tax law changes.”