Taylor Morrison Homes Corp., Scottsdale (NYSE:TMHC) on Wednesday reported a net loss of $31.4 million, or ($0.26) per share, for the first quarter ended March 31. The loss, which was driven primarily by $123 million of transaction expenses that impacted earnings before tax, compared with a gain of $51.1 million, or $0.46 per share, in the prior year quarter. Analysts were expecting a gain of $0.44 per share.

Home building gross margins were impacted by about 220 basis points from purchase accounting.

First Quarter 2020 Highlights:

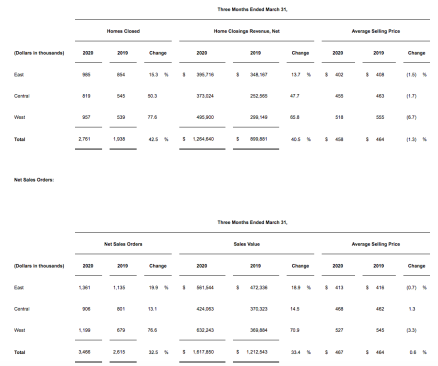

• Net sales orders were 3,466, approximately a 33% increase over the prior year quarter

• Average monthly sales pace per community was 3.1, compared to 2.3 from the first quarter 2019

• Home closings were 2,761, an almost 43% increase over the prior year quarter

• Total revenue was $1.3 billion, an almost 46% increase over the prior year quarter

• SG&A as a percentage of home closings revenue was 10.8%, down 70 basis points from first quarter 2019

• Home building gross margins were impacted by 220 basis points from purchase accounting

“When I look at the first 10 weeks of the year compared to the seven weeks since the onset of the pandemic, they couldn’t look more different,” said Sheryl Palmer, Taylor Morrison chairman and CEO. “While we’re pleased with our first quarter results, what I’m most encouraged to see is the momentum we built in April where we saw week-over-week improvement throughout the month in both gross and net sales. Specifically, the number of gross sales in the last week of the month were more than two and a half times the number of sales in the first week, while the number of net sales, given the reduction in cancellations, was nearly five times the sales recorded in the first week.”

The company finished the first quarter with sales orders of 3,466, which was up approximately 33% from the prior year quarter. This represented a sales pace per community for the quarter of 3.1, which was also up nearly 35% from the sales pace of 2.3 in the first quarter of 2019.

“When looking at the buildup of sales through the quarter, you can easily see the impact of the COVID-19 restrictions that began in mid-March,” added Palmer. “Consistent with most of the industry, our sales orders in the first two months of the year started extremely strong with January sales up 46% compared to the same period last year and a pace of 3.2. February sales were up 64% with the pace increasing to 3.5 and continuing into the first half of March. However, the last 10 days of March were slower with a deceleration in the sales pace to 2.5 as our team and the broader market adjusted to our new reality.”

“With the impact of COVID-19, there hasn’t been a single part of our business that hasn’t had to change in some capacity to adapt,” said Palmer. “When I look at our sales team and the 180-degree turn they’ve made to conduct their business virtually, it’s quite impressive. We’ve now seen triple digit sales conducted entirely virtually—meaning no prior physical interaction with the home buyer whatsoever.”

In response to the crisis, the company added new features to its website enabling customers to schedule virtual and private in-person appointments with ease.

Said Palmer, “More than 1,500 appointments have been scheduled within the past four weeks through our new online scheduling feature—a first of its kind in our industry. While customers have the ability to schedule in-person or virtual appointments—the latter of which makes up more than 85% of the appointments to-date—they can also schedule appointments specifically to write contracts, which we’re also seeing. In fact, more than 20% of our April net sales were completely virtual.”

“We ended the quarter with about $750 million in total available liquidity,” said Dave Cone, executive vice president and CFO. “More than $500 million of that was cash on hand with the remaining difference from available capacity on our $800 million corporate revolver. Our net home building debt to home building capitalization ratio was 46.8% at quarter end. Given COVID-19, we have been successful in deferring and reducing land and development spend that does not provide near term closings for the business, and we anticipate that our net debt to home building capitalization ratio peaked in first quarter of 2020.”

“With the closing of our William Lyon acquisition in February, we had about $123 million of transaction expenses that impacted earnings before tax and homebuilding gross margins were impacted by about 220 basis points from purchase accounting,” said Cone. “With that in mind, our adjusted net income for the quarter was approximately $70 million demonstrating the strength of our core operations.” GAAP net income was a loss of $31 million.

For the quarter, GAAP home closings gross margin was 15.4%, inclusive of capitalized interest and purchase accounting.

“Adjusting for purchase accounting, home closings gross margin was 17.6% for the quarter. We anticipate the second quarter purchase accounting impact to be at or slightly below the first quarter recognizing that it will include a full quarter impact of William Lyon operations and should continue to moderate in the second half of the year,” added Cone. “Also, we had a focused effort of selling through finished speculative inventory from legacy William Lyon, which pressured margins during the quarter. We anticipate margins increasing closer to our pre-acquisition levels as we move through the second half of the year working through purchase accounting, finished spec inventory and realizing purchasing and construction synergies.”

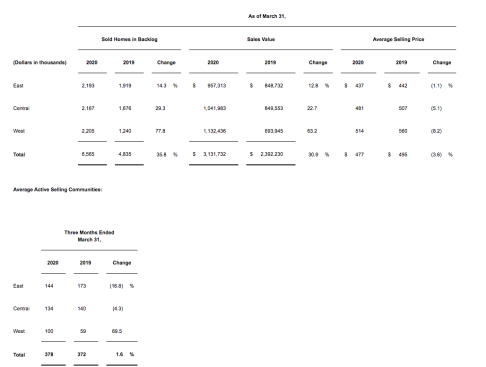

The company ended the quarter with 6,565 units in backlog, a year-over-year increase of almost 36%, with a sales value of approximately $3.1 billion. As of March 31, 2020, Taylor Morrison owned or controlled approximately 75,000 lots, representing 5.3 years of supply of which 3.9 years were owned, based on a trailing twelve months of closings including a full-year impact from William Lyon.