Toll Brothers, Inc. (NYSE:TOL) Horsham, Pa. on Wednesday after market close reported net income and earnings per share were $75.7 million and $0.59 per share diluted, for its second quarter ended April 30, 2020. The gain compared to net income of $129.3 million and $0.87 per share diluted in FY 2019’s second quarter. The gain handily beat analyst expectations of $0.45 per share.

Among the results:

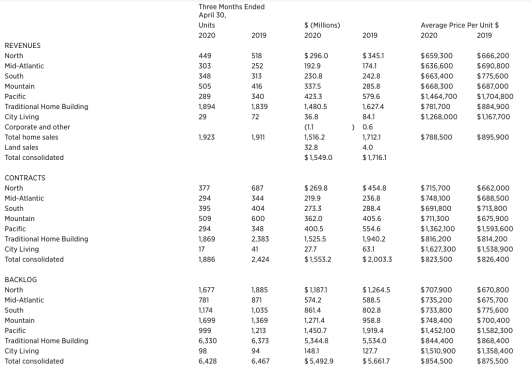

• Home sales revenues were $1.52 billion, down 11%; home building deliveries were 1,923, up 1%.

• Net signed contract units were 1,886, down 22%; contract value was $1.55 billion, down 22%.

• Backlog in units at second-quarter end was 6,428, down 1%; backlog value was $5.49 billion, down 3%.

• Home sales gross margin was 17.5%; Adjusted Home Sales Gross Margin, which excludes interest and inventory write-downs, was 21.0%.

• Pre-tax inventory write-downs totaled $14.2 million.

• SG&A, as a percentage of home sales revenues, was 11.8%.

• During the quarter, the company undertook a number of cost reduction initiatives to improve efficiencies and rationalize overhead expenses, including workforce reductions. The company expects these actions will decrease overhead expenses by approximately $50 million on an annualized basis, with approximately $25 million of savings in the remainder of fiscal 2020.

• Income from operations was $92.5 million.

• Other income, income from unconsolidated entities, and land sales gross profit was $16.0 million.

• As previously announced, due to the business disruption and the evolving and uncertain impact of the Covid-19 pandemic on the U.S. economy, the company has withdrawn its full fiscal year 2020 guidance and will suspend providing such guidance for the foreseeable future.

Douglas C. Yearley, Jr., chairman and CEO, stated: “We are pleased with our performance in the second quarter as our team delivered solid results under very challenging conditions. Our second quarter was essentially bifurcated by the impact of Covid-19. Fueled by strong demand, a healthy economy, low mortgage rates, and a limited supply of new and existing homes nationwide, our net signed contracts were up 43% through the six weeks ended March 15, 2020, compared to the prior year’s same period. With approximately 40% of our selling communities and 50% of the dollar value of our backlog concentrated in highly impacted markets, from March 16 through April 30, our net signed contracts declined 64% year over year. Government stay-at-home and business closure orders in these markets, which included Pennsylvania; New Jersey; New York City and its suburbs; Connecticut; Massachusetts; Michigan; metro Seattle and California, made it especially challenging to sell, construct and deliver homes. Fortunately, government restrictions have eased and sales and construction operations have resumed in almost all of our markets.

“While net signed contracts in the first four weeks of May were down 37% year-over-year, we are very encouraged by recent deposit activity. Our deposits, which typically precede a binding sales contract by about three weeks and represent a leading indicator of current market demand, were up 13% over the past three weeks versus the same three-week period last year. Importantly, our recent deposit-to-contract conversion ratio has remained consistent with pre-Covid-19 levels. Web traffic has also steadily improved from the lows we experienced in mid-March and has returned to the same strong activity we enjoyed pre-Covid-19 in February. These early trends suggest the housing market may be more resilient than anticipated just two months ago.

“We ended our second quarter with approximately $2.0 billion of liquidity, including $741 million of cash and marketable securities and $1.3 billion available under our $1.9 billion revolving credit facility, which does not mature until November 2024. With no significant debt maturities until February 2022, our balance sheet is strong.

“I would like to thank all of our Toll Brothers team members. I am so proud of how they have responded to the challenges we have faced during this time. We have seen first-hand their creative thinking, how hard they are working, and their incredibly positive spirit. They are completely dedicated to moving our great company forward while taking care of our customers every step of the way.

“With our trusted brand, experienced management team, diversified product offerings, strong liquidity, and high-quality land holdings, we believe we are well prepared for the immediate challenges ahead. We also believe we are well positioned to take advantage of the favorable long-term demographic and supply-demand trends underlying the housing market, which we expect will continue supporting the industry as the economy recovers.”