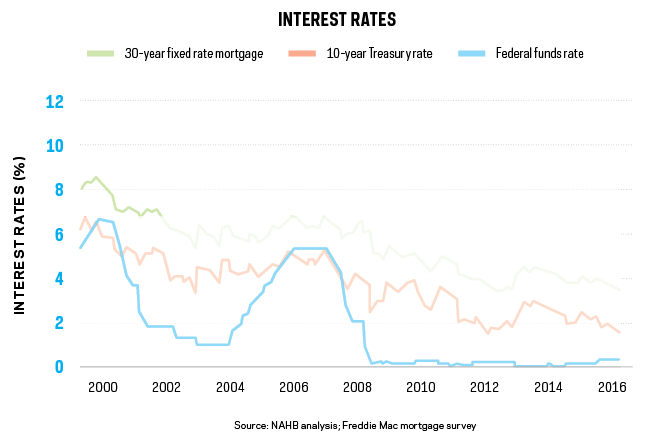

After years of the federal funds rate holding at effectively zero, monetary policymakers are now normalizing short-term rates. This will be a slow but necessary process after the Federal Reserve adopted extraordinary measures to keep rates low for most of the past decade.

The reasons for this policy stance—stimulus in response to the financial crisis and the Great Recession—have now passed. And the Fed risks inflation by holding rates low indefinitely. For this cycle, we experienced the first federal funds rate hike of 25 basis points at the end of 2015.

The economics team at NAHB previously had forecasted two rate hikes in 2016. However, given low GDP growth for the last quarter of 2015 (0.9%) and the first two quarters of 2016 (0.8% and 1.4%), the Fed held back on raising rates through the first half of the year. As such, NAHB forecasts that the next increase will occur at the December meeting.

We can expect more moves in 2017. A key trigger for inflation is growth in wages due to a constrained labor market. The U.S. unemployment rate has been 5% or lower since October 2015. Combine that with a rising number of unfilled jobs, and labor market conditions are tight and inflation risks are rising. But weak GDP numbers, and limited prospects for growth above a 3% rate in the years ahead, put monetary policymakers in a tough spot balancing the Fed’s dual mandate to keep both inflation and unemployment low.

As the Fed raises short-term rates, what happens to mortgage rates? Mortgage rates will rise, but not on a one-for-one basis. In general, the 30-year fixed rate mortgage tracks the rate for the 10-year Treasury bond. But the bond and federal funds rates do not necessarily travel together. Mortgage rates and the 10-year rate are actually lower now than they were before the first Fed rate increase. Why?

The answer relates to investor preferences. In times of economic and political uncertainty, investors seek relatively risk-free yields in a flight-to-quality effect. This leads to purchases of 10-year Treasury bonds, pushing bond prices up and holding interest rates down.

We expect mortgage interest rates to rise as the Fed normalizes monetary policy in the years ahead. But ongoing market conditions, including weak GDP growth and ongoing market uncertainty, should constrain how fast mortgage rates increase. As such, we forecast that the 30-year fixed rate mortgage will average 5% for 2018—higher than today but low by historical comparisons. The primary challenge for prospective home buyers will continue to be saving for a down payment.