Led by the Southern California region, California pending home sales registered gains on a month-to-month and year-to-year basis, portending a moderate increase in sales in the near term, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

The modest sales growth is unlikely to be sustained, however, given the severe shortage of homes for sale and affordability concerns, as indicated in C.A.R.’s December Market Pulse Survey, which saw fewer listing appointments and less open house traffic.

Based on signed contracts, statewide pending home sales increased in December on a seasonally adjusted basis, with the Pending Home Sales Index (PHSI)* rising 1.9% from 115.8 from December 2015 to 118.1 in December 2016 – even with new mortgage rules that pushed sales higher December a year ago. On a monthly basis, California pending home sales were up 3.3% from the November index of 114.4.

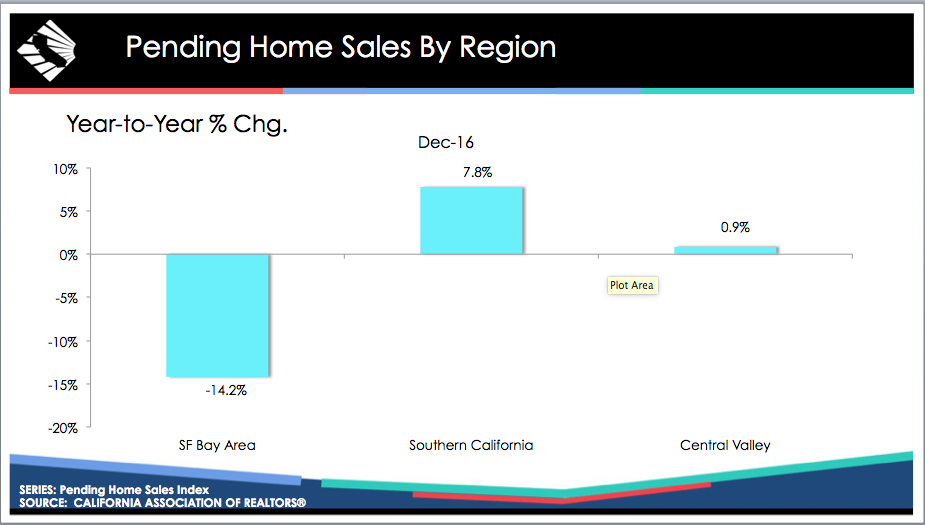

Southern California saw the largest increase in pending sales last month, rising 7.8% on an annual basis and decreasing 16.1% on a monthly basis. Thanks to the highest level of available homes for sale and greatest affordability, San Bernardino led the region in pending sales, posting a 9.5% increase from a year ago. Los Angeles and San Diego counties also posted modest year-over-year increases of 5.2% and 7.9%, respectively. Orange County was the only area within Southern California that saw pending sales lower on an annual basis by 11.5%.

On the flip side, in the San Francisco Bay Area as a whole, tight housing supplies and low affordability contributed to a fall in pending sales of 14.2% compared to December 2015 and 32.5% from November. San Mateo County led the region’s decline at 35.3%, followed by San Francisco County at 23.3%, and Santa Clara County at 18.6%. The significant year-over-year sales decline in the Bay Area can be attributed to the prevalence of higher-priced properties in the region that were affected by new mortgage lending rules implemented in fall 2015.

Overall pending sales in the Central Valley improved 0.9% from December 2015 and were down 18.4% from November. Within Central Valley, pending sales were up 5.2% in Kern County and 7.6% in Sacramento compared with a year ago.

Reflecting the typical seasonal slowdown, California REALTORS® responding to C.A.R.’s December Market Pulse Survey reported a decline in floor calls, listing appointments, and open house traffic.

The share of homes selling below asking price fell from 57% a year ago to 43% in December. Conversely, the share of properties selling above asking price increased to 23% from 18% in December 2015. The remaining 34% sold at asking price, up from 25% in December 2015.

For homes that sold above asking price, the premium paid over asking price rose to 11%, up from 8.4% in November and 9.2% a year ago.

The 43% of homes that sold below asking price sold for an average of 22% below asking price in December, double the November figure of 11%, and was up from 13% from a year ago.

Nearly two-thirds of properties for sale (64%) received multiple offers in December, down from 66% in November and 65% in December 2015.

The share of properties receiving three or more offers in December increased to 40%. 36% of properties received three or more offers in November, and 40% of properties received three or more offers a year ago.

Compared to a year ago, homes priced $400,000 to $499,000 and $2 million and higher experienced the greatest drop in three or more offers, while only homes priced $500,000 to $749,000 and $750,000 to $999,000 experienced an increase in three or more offers.

More than one-fourth (26%) of properties had listing price reductions in December, down from 31% in November and 30% in December 2015.

High home prices and housing affordability were the top concern for 38% of Realtors. Climbing for four straight months, a lack of available inventory concerned 29% of Realtors, followed by inflated home prices/housing bubble cited by 18%. A slowdown in economic growth, lending and financing, and policy and regulations rounded out remaining biggest concerns.

Expectation of market conditions over the next year climbed for the fifth straight month to an index of 65 in December, up from 58 in November but unchanged from December 2015.