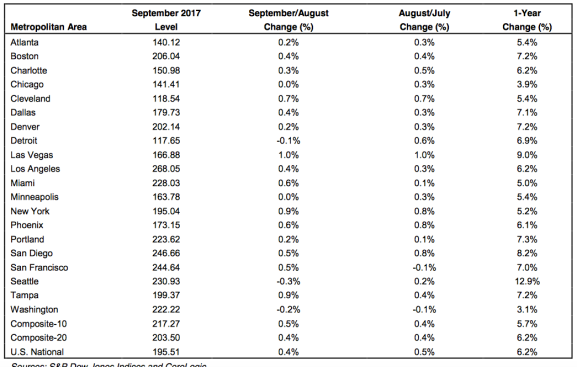

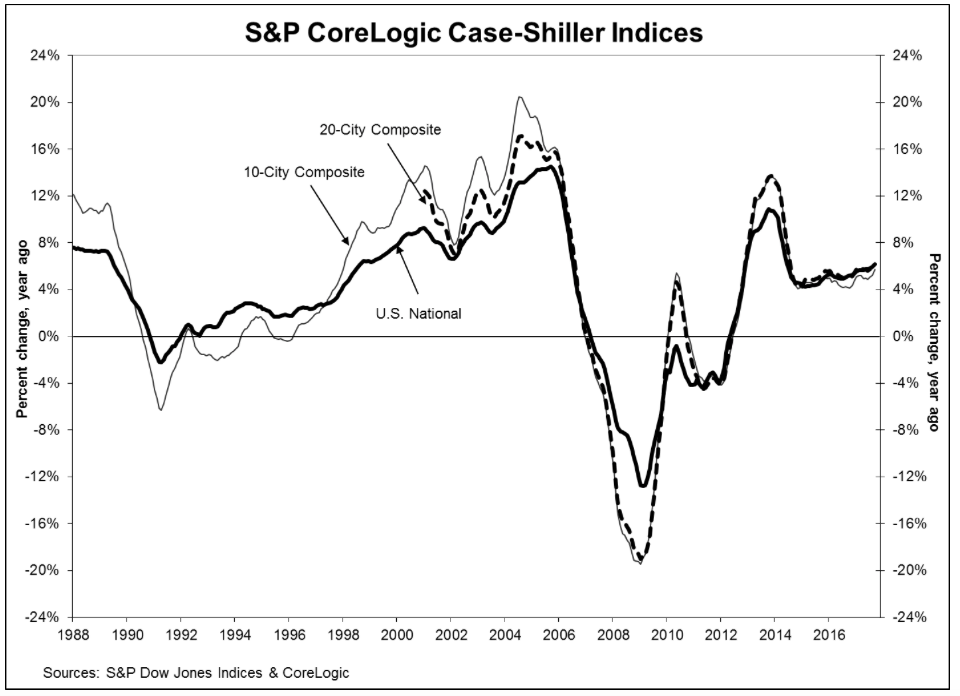

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.2% annual gain in September, up from 5.9% in the previous month, S&P reported Tuesday.

The 10-City Composite annual increase came in at 5.7%, up from 5.2% the previous month. The 20-City Composite posted a 6.2% year-over-year gain, up from 5.8% the previous month.

Seattle, Las Vegas, and San Diego reported the highest year-over-year gains among the 20 cities. In September, Seattle led the way with a 12.9% year-over-year price increase, followed by Las Vegas with a 9.0% increase, and San Diego with an 8.2% increase. 13 cities reported greater price increases in the year ending September 2017 versus the year ending August 2017.

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.4% in September. The 10-City and 20-City Composites reported increases of 0.5% and 0.4%, respectively. After seasonal adjustment, the National Index recorded a 0.7% month-over-month increase in September. The 10-City and 20-City Composites posted 0.6% and 0.5% month-over-month increases, respectively. 15 of 20 cities reported increases in September before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

“Home prices continued to rise across the country with the S&P CoreLogic Case-Shiller National Index rising at the fastest annual rate since June 2014,” said David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices. “Home prices were higher in all 20 cities tracked by these indices compared to a year earlier; 16 cities saw annual price increases accelerate from last month. Strength continues to be concentrated in the west with Seattle, Las Vegas, San Diego and Portland seeing the largest gains. The smallest increases were in Atlanta, New York, Miami, Chicago and Washington. Eight cities have surpassed their pre-financial crisis peaks.”

“Most economic indicators suggest that home prices can see further gains,” Blitzer contined. “Rental rates and home prices are climbing, the rent-to-buy ratio remains stable, the average rate on a 30-year mortgage is still under 4%, and at a 3.8-month supply, the inventory of homes for sale is still low. The overall economy is growing with the unemployment rate at 4.1%, inflation at 2% and wages rising at 3% or more. One dark cloud for housing is affordability – rising prices mean that some people will be squeezed out of the market.”

Lawrence Yun, chief economist for the National Association of Realtors, linked the new data to the persistant shortage of inventory.

“Home prices, after multiple years of fast growth, still show no signs of cooling because of the ongoing housing shortage in much of the country,” said Yun. “The latest Case-Shiller price growth of 6.2% on a nationwide basis marks the strongest rise in over three years. This fast appreciation over income growth is not sustainable over many years.”

Yun added, “Housing demand is clearly rising from the improving labor market, but supply is still not kicking higher. Homes for sale are quickly going under contract, and overall existing inventory has fallen for 29 consecutive months (on a year-over-year basis). Either demand will chocked off from weakening affordability, or more robust construction needs to take place to calm home prices. The latter is the much preferred outcome, and would be a win for homebuyers, a win for homebuilders and win for faster economic growth.”